|

Getting your Trinity Audio player ready…

|

Mobile network operators saw a decline in voice and internet traffic in the first quarter but revenue grew 10% to $28.8 billion from $26.17 billion recorded in the preceding quarter.

According to the latest sector performance report from the Postal and Telecommunications Regulatory Authority of Zimbabwe (POTRAZ), mobile voice traffic declined by 2.3% to 1.77 billion minutes in Q1 as consumers continued to prefer cheaper Over-the-Top services. However, the rate of increase was much slower than the 14.3% decline seen in Q4.

POTRAZ noted that the current economic environment is acting against the sector as the authority called for intervention at both the operator and fiscal levels. “The economic climate characterised by depressed consumption, inflation, foreign currency constraints, and reduced network investment among other challenges is manifesting in reduced traffic volumes, increased operating costs, and reduced capital expenditure in USD terms in the quarter under review,” said the regulator.

POTRAZ called on operators to innovate and explore sustainable revenue generation and cost containment avenues considering the current economic climate. “On the other hand, monetary authorities need to consider the prioritisation of the sector in terms of foreign currency given the capital-intensive nature of the industry. Review of policies, such as customs and excise levies, will improve the affordability of devices and services, thus promoting overall demand and revenues.

The total number of active mobile subscriptions was 14,289,085, a 0.2% growth from 14,257,590 recorded in Q4. Econet was the only mobile network to record growth in active subscriptions (1.1%) with NetOne and Telecel recording declines of 1.1% and 5% respectively. For NetOne, this is the first quarter over the past year, to record a decline in active subscriptions.

SMS traffic declined by 12.7% to 2.4 billion messages from 2.8 billion messages in Q4.

Mobile internet and data traffic were down 14.9% after 22 052 Terabytes of mobile internet and data were consumed. The decline in internet and data traffic was experienced across all three mobile networks due to declining data affordability and of declining disposable incomes. However, the total number of active internet and data subscriptions increased by 1.1% to reach 9,644,271 as of March 31.

Total mobile network revenue was $28.8 billion, up 10% increase from $26.2 billion recorded in the fourth quarter of 2021 with voice contribution to revenue declining to 42% while mobile data grew to 39.3% from 38.1%.

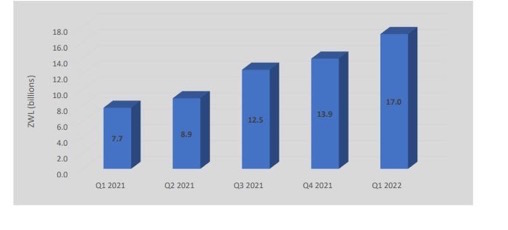

Operating costs grew by 22.7% to $17 billion from 3.1 billion recorded in Q4. Bandwidth costs, staff costs, and depreciation continued to be the main cost drivers for mobile operators.

Mobile network operating costs

Capital expenditure by the mobile network operators increased by 39.3% to record $1.72 billion in Q1, from $1.24 billion recorded in the fourth quarter. The capital expenditure by mobile operators was in national switching, national transmission as well as hardware and software. In terms of infrastructure, a total al of 10 new 2G, 40 new 3G, 42 LTE eNode Bs, and 10 new 5G base stations were deployed in the quarter. Notably, a total of 23 of the 43 LTE eNode Bs, were deployed in rural areas. All 5G base stations were deployed by Econet for a Proof of Concept (POC) trial.

SOURCE: FINANCIAL EXPRESS