As the 38th African Union (AU) Summit roared to life today, the African Forum and Network on Debt and Development (AFRODAD), the One Campaign, and Christian Aid, through an online webinar, urged African Heads of State and Government and the African Union Commissioners who will take office to consider taking urgent initiatives to reform global financial institutions like the International Monetary Fund (IMF) and World Bank.

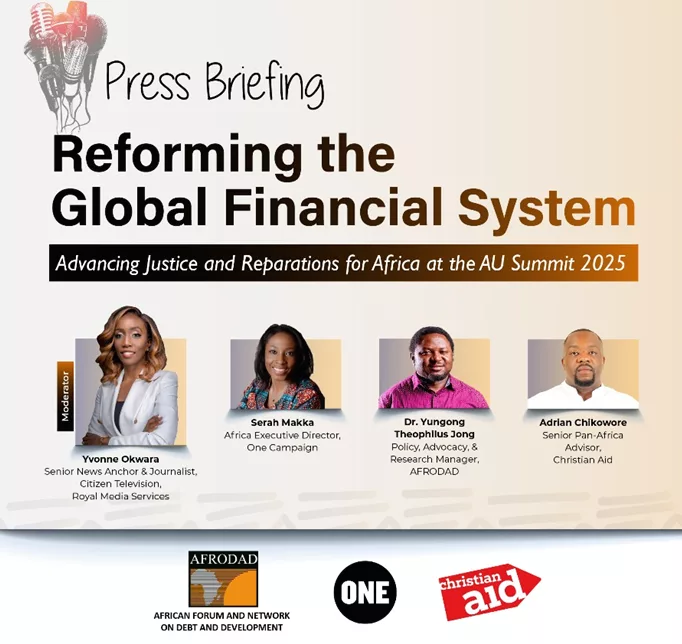

The webinar was moderated by Yvonne Okwara, a Senior news Anchor and Journalist with Citizen Television.

Addressing a press briefing during a webinar on “Reforming Global Finance: Advancing Justice and Reparations for Africa” that focused on linking reparations to global development processes and Africa’s economic sovereignty and South Africa’s pivotal role as a G20 chair, Adrian Chikowore, the Senior Pan-Africa Advisor of Christian Aid said the summit is uniquely placed to lead the continent’s call for reparations, advocate strongly for justice on the global stage, ensure that the voices of affected communities are sufficiently represented and that meaningful solutions are implemented.

“So what does it take to move towards the reform of the global financial architecture vis-à-vis reparative justice? I think the first point of call would be debt cancellation and the reform of the global financial architecture itself. Why do I say so? The current global financial system has deep historical roots in the equities of colonialism. It is basically dominated by international financial institutions such as the IMF as well as the World Bank, but this also includes global capital markets which are heavily influenced by philosophical positions that prioritize market liberalism, and predator dominance,” Chikowore said

He said after decades of extractivism on the continent’s resources, these institutions have contributed far more to the inequalities and destitution seen in Africa.

“And because of their conditional lending policies that have come in the guise of economic reforms, this has led to unrest in several African countries as a result of the unfair and unpopular policies that we see. In technical terms, we call them austerity policies, and we have seen the implications of the same within Kenya in the last year. But then there is a role for the AU to play with regard to the same. I believe African countries need to pursue the decoloniality of the IMF and the World Bank, which are institutions that were created before many African countries gained independence. And in such a way, they are still not representative of the continent.

“The governance of the IMF and the World Bank are dominated by wealthy nations, with voting power determined by financial contributions rather than equity or development needs. African countries have very little voting power, with less than 10% voting share, and are represented by only two executive directors. These imbalances have marginalized Africa and the global south, and their needs are often overshadowed. As such, there is a need for the AU to coordinate African countries in the context of having to promote alignment of African countries’ positions in global spaces, such as the UN, financing for development, and even the G20,” Chikowore added.

He said that this has to be within the realm of debt cancellation and the establishment of a multilateral debt resolution framework.

“The UN is a country where nations have a voice, and it is a country where nations can establish a more representative architecture for the reformed international financial architecture. I will also speak about the UN processes. It is also important to note that the African Union, through one of the Abulja treaties, actually created its own financial architecture. It is also important to strengthen that so that we can be self-sufficient.

It is also important to note that debt cancellation and reform of the global financial architecture can also be coupled by lobbying the UK government on the cancellation of private sector debt, as most debt owed by countries to private creditors is governed by English law.”

He called for fair public climate finances reparations. In the global north countries, development has been driven by carbon-intensive industrialization as a result of extraction from Africa and has had disproportionate effects on the continent. So, there is a need to ensure that African countries also leapfrog from the crisis it is facing concerning climate change.

“We need to ensure that the climate crisis is resolved and finance is at the core of the same. So, one plea that can be put on the table is to ensure that the AU and the African group of negotiators are consistently aligned on the need for climate finance to be delivered predominantly as grants and not loans. The provision of this finance is a moral obligation, the payment of an ecological debt owed by historical emitters to countries that have played little part in causing the climate crisis but are on the front line of the impacts. This needs to be addressed and the reform of the global financial architecture translates even into the climate finance architecture that needs to be resolved.”

Dr. Yunggong Theophilus Jong, Policy and Advocacy Manager, African Forum and Network on Debt and Development (AFRODAD) said global financial governance laws were set by the colonialists who put African countries through slavery and colonialism.

“The current global financial system is more extractivist and preys on African countries and their resources. So reforming the global financial architecture does not only mean looking at the financial institution per se because we also have here non-financial institutions that are key players in this process. For instance, the OECD countries have informal arrangements, like the Paris Club members. These are key decision-makers when it comes to issues of lending, when it comes to bilateral creditors, and they have a significant influence on the policies of the IMF and the World Bank. You will know that actually, the IMF is a European-led institution, while the World Bank itself is the prerogative of the U.S. president to appoint who sits there.

“And you see the kind of disequilibrium when it comes to actually power-sharing, you know, collective decision-making in these institutions. And then you find that in this process, African countries are nowhere to be found when it comes to setting the rules and making decisions. He who pays the piper calls the tune in this system. Reforming the global financial architecture requires that we move away from these arrangements to more democratic arrangements,” Dr Jong said.

He said Africa’s Agenda 2063 is about giving African countries more voice and changing the rules of the system. The Mbeki Report talks about African countries losing revenue in terms of illicit financial flows due to the distorted global financial system.

Dr Jong underscored the need for African countries to reform the global financial architecture to seal the leakages. He condemned excessive borrowing by African countries until they get to points where they have debt burdens that they are unable to service.

“Of course, reforming the global financial architecture also means reforming these institutions, not just the rules, but the structures. And this is why we’re also recommending that it should involve, you know, going through the United Nations. Because when you look at the multiple crises that African countries have faced, it’s part of this system that has been extractive for several decades, dating back to issues around slavery and the slave trade, through colonialism. And this is where the issues of reparative justice come in, in this entire discussion. Because reparative justice here is not just about giving African countries money, but reforming these policies, right?

Serah Makka, Africa Executive Director at the ONE Campaign said apart from the global financial architecture, there are African responsibilities that stakeholders should not ignore.

“This discussion is just part of the problem, right? And for us to get to the point where we have that voice, where we can have a voice at the table, where we can be the rule maker, I think it starts with issues of governance, internal governance in Africa. After that, we talk about the African Borrowing Charter which should guide countries on how they borrow in terms of maintaining sustainable debt levels. So issues of internal governance are very important. Actualizing the African Union blueprint is very important starting from the regional economic communities for us to have a coordinated approach to these problems.

“This requires not just the technical inputs but also the political will to be able to have this blueprint because if you look at it, it is quite clear you see the major economies, the bilateral creditors they are more coordinated. You hear of the G20, you hear of OECD countries, you hear of the Paris Club. These creditors are even more coordinated and they’re the ones with the resources. They’re the ones with the financial resources,” Makka said.

She bemoaned the fact that Africa provides only about 2% of global economies.

“We have stubbornly refused to add value to the God-given gifts and talents that are underneath our earth. Our African Union leaders on the continent must be in the driver’s seat of this. Until we find a way to increase the revenue of our resources, we don’t have a chance to make money in the global polity and economic landscape. We have assets. How are we using them? Are we adding value? Or are we still exporting? Our assets for raw products, whether it’s cocoa or oil, we have been exporting as raw materials for the last 60 years when everyone else has added value. Or will we get a chance to say, enough, we need to add value so we can get revenue, so we can play in the global economy,” she added.

The African Continental Free Trade Area (AFCTA) provides intra-African trade to build and reduce tariff and non-tariff barriers. If utilized efficiently, this could be a response to the inequalities within the UN World Trade Organization.