The year 2018 witnessed the resurgence of NetOne as the leading Network of Choice in Zimbabwe, with a historic $88 million turnaround from a loss position of $77 million in 2017, to a profit of $10 million in 2018, company Chief Executive Officer Lazarus Muchenje has said.

“Our EDITDA grew from $15,1 million to $38,2million, which translates to a 153% growth, in cash generated by operations. In addition, NetOne realised a revenue of $119,2 million representing a 13% growth from prior year. This was achieved on the back of cost containment initiatives, comprising of enhanced efficiency and cost discipline. As evidenced by the 21% decrease in the overheads margin, to end the year at 48% against 69% for prior year.

“As a company we made the conscious decision to adopt a Back to Basics approach premised on four key strategic pillars, namely Quality Network, Quality Distribution, Quality Contact Centre and a Quality Balance Sheet. Network availability is operating optimally at 99%, from 95% prior to April 2018. The improvement in network quality has been as a result of re-farming of 137 2G sites, across the country, thereby availing 3G Services to these areas without the need to invest in additional hardware,” Muchenje said.

Further to this, NetOne implemented a base station redeployment exercise, whereby 3G base stations were moved from areas of low utilisation to areas of high utilisation and demand in urban areas in order to densify coverage and augment available capacity in these areas. 3G Sites were also upgraded from 3 sector to 6 sector effectively doubling the data capacity at the sites.

With enhanced network provision, Muchenje said there is increased demand for products, which brings NetOne to yet another key strategic focus area – Quality Distribution. NetOne adopted a deliberate strategy to improve the accessibility of its products, whilst capacitating small to medium enterprises to increase their revenue generation capacity through the distribution of its products and services.

As such, an additional 638 channels, in the form of franchise shops, were created in 2018 alone to complement the 34 NetOne shops. The company is mindful of the criticality of accessibility and availability of its products, which drives it to be strive to meet the needs of its customers, across the length and breadth of the country.

In addition to this, NetOne is leveraging on the electronic distribution channels, whose contribution grew from 14% to 21% in 2018. This is to provide real-time, on demand and round the clock service delivery to its customers.

As part of its efforts to support youth empowerment and job creation, NetOne continued to recruit school leavers to join its Basa SeBasa Brand Ambassador initiative. This is to support its airtime agent network that also grew to over 3,000 in 2018.

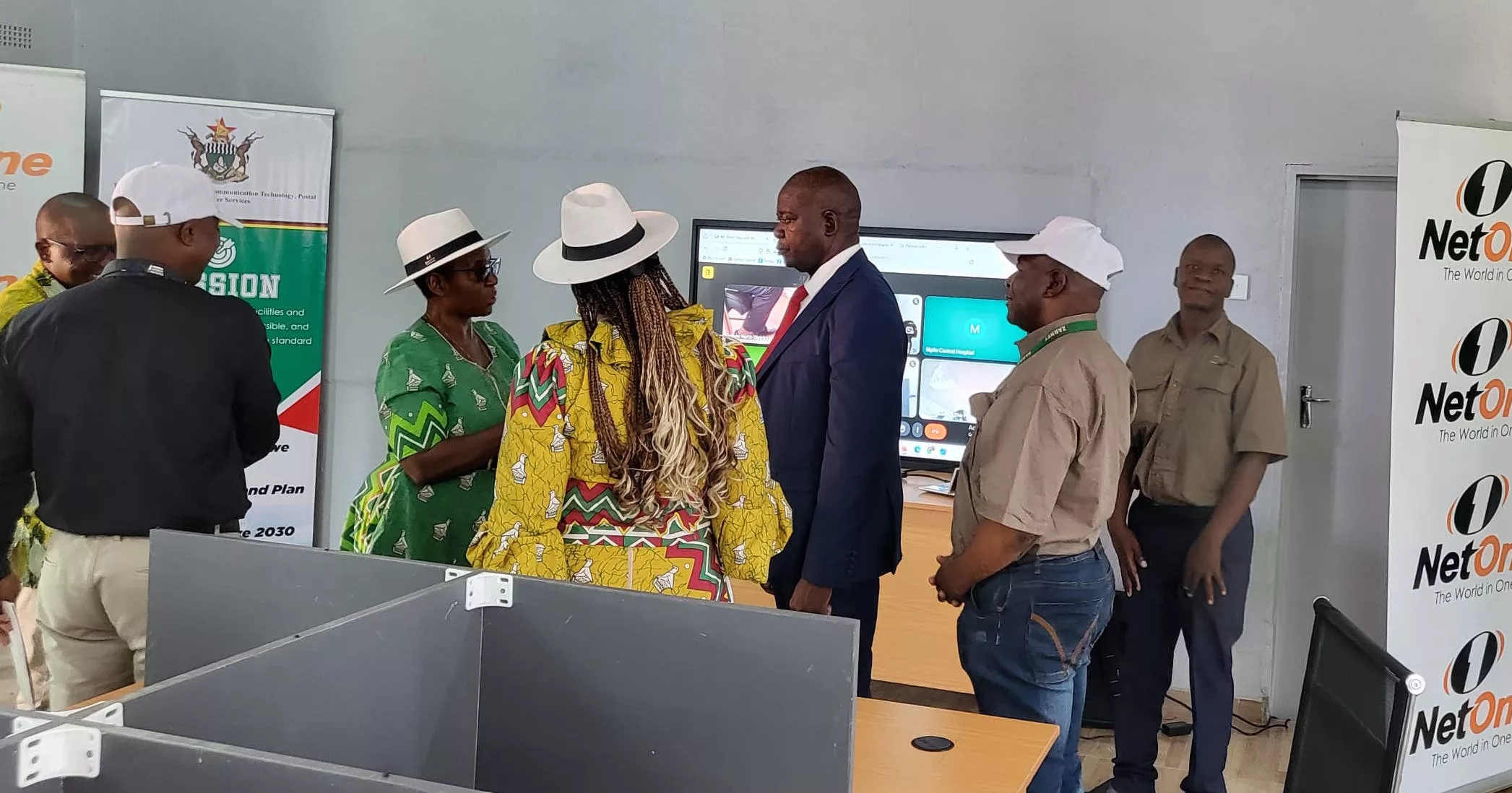

Providing a seamless customer experience remained the lifeblood of the organisation, which is why Quality Contact Centre is one of its key strategic focus areas. The quality of NetOne customer service is one of its key assets and strengths, and the company takes pride in the recognition that it has received from the Contact Centre Association of Zimbabwe (CCAZ), as well as market feedback, wherein respondents gave NetOne the highest customer service rating in a Quality of Service survey commissioned by our regulator Postal and telecommunications regulatory Authority of Zimbabwe (POTRAZ).

A Quality Balance Sheet remains a key focus area for NetOne, as the restructuring of its balance sheet remains critical for it to build the necessary capacity for a sustained momentum and flexibility that a cash rich company benefits from. Because the health of its balance sheet matters, NetOne’s primary focus is to narrow the liquidity gap and restore value of the entity, which has been earmarked for partial privatisation.

“I am pleased to report that the company has made strides in doing so, with a major milestone being the reduction of negative working capital by 74% from $228.6 million to $59.4 million during the year ended 2018. Our Mobile Financial Service platform, One Money’s market share grew to 2.5% in 2018, witnessing the registration of 1.2 million subscribers. This was premised on our stable delivery platform, offering the best value per transaction, cemented by its ability to connect to all banks via the Zimbabwe Shared Services Platform ZIPIT.

“In order to diversify our business model, Value added services, particularly around Media and Entertainment, is a key battle ground for NetOne. This will consolidate our data services, thus providing a stage for the provision of ethical and engaging content to entertain of our customers. NetOne is creating a better future and through our committed staff, we are confident that our obligation to customers and shareholders will be fulfilled beyond measure in the year 2019,” Muchenje added.