The successful implementation of the African Continental Free Trade Area (AfCFTA) could help Eastern African countries reap $1.8 billion and revive the region’s intra trade, a new report from the UN Economic Commission for Africa (ECA) indicates.

Andrew Mold, officer in charge of ECA’s sub-regional office based in Kigali, told Business Times that the $1.8 billion are consumer welfare gains, but the benefits could be much more.

“The amount is principally the lower prices paid for imported goods, but with the expectations that real gains could be much larger. It all stems from this fact that consumers in our regions pay more than they should pay for goods,” he said.

The economies of East Africa are still highly fragmented, but the latest report asserts that the full implementation of the African Continental Free Trade Agreement, which was signed by 44 countries in Kigali in 2018, offers hope of a revival of both regional and intra-African trade.

The levels of intra-regional trade and investment are low and have recently been declining in the sub-region.

The two largest economies in the region – Kenya and Ethiopia – barely trade with each other. Their annual bilateral trade is worth less than $100 million.

According to ECA, intra-regional trade within the East African Community (EAC) declined between 2013 and 2017. Trade was at $3.5 billion in 2013 and fell to $2.4 billion in 2017.

“The lack of integration represents a serious impediment to the future development of the region,” the report which was conducted jointly with TradeMark East Africa reads in part.

Mold said there is no better time to push for the AfCFTA agenda than today.

“At a time of great uncertainty in global trade, the regional route is the way to go and the AfCFTA paves the way for that,” he said.

Mold, who’s also one of the report’s authors, added that there is a lot to gain for East Africa and it goes “beyond increasing intra-regional trade.”

According to ECA, the AfCFTA could generally boost intra-African exports by more than $1.1 billion and create more than 2 million new jobs.

The status quo

A breakdown of trade imbalances by sector shows that deficits are driven almost exclusively by manufactured goods imports.

The region’s heavy reliance on intermediate goods and manufactured products imported from the rest of the world hampers the full utilization of local productive capacities.

Currently, manufacturing firms in East Africa are typically operating at around 20 per cent to 40 per cent below their potential.

The report argues that the heavy reliance on manufactured imports also results in many missed opportunities to develop deeper regional value chains, both within East African and with the rest of the continent.

The Commission says in its report that the elimination of tariff and non-tariff barriers and harmonization of standards called for under the AfCFTA represent a unique opportunity to boost intra-regional trade and investment.

This could go along to allow companies and farmers to tap into rapidly growing markets, both within the region and in other parts of Africa.

Expectations

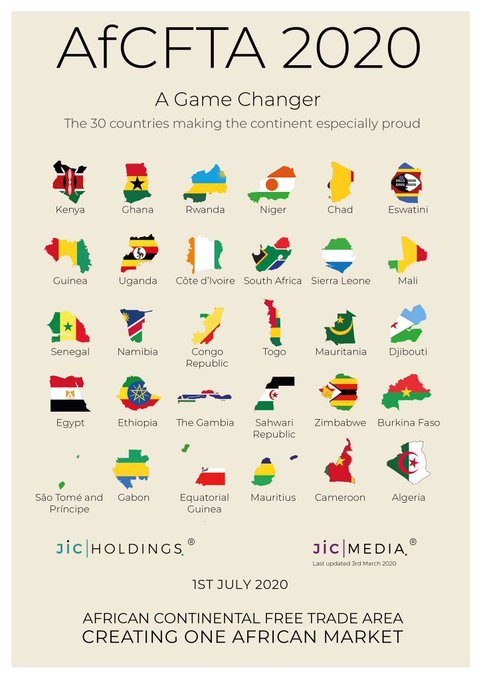

The AfCFTA will potentially cover all 55 member states of the African Union (AU), making it the world’s largest free trade area since the formation of the World Trade Organization in 1994 in terms of the number of participating countries.

So far, 54 African Union member states have signed the agreement highlighting a remarkable degree of consensus in a large.

Experts have overly insisted that implementing the agreement through regional economic communities can fast-track the process and ensure that countries benefit from the free trade area in a not-so-distant future.

The East African sub-region is one of the most economically active regional economic blocs in the continent. It has become the fastest growing sub-region on the continent, with economic growth averaging 6.6 per cent since 2014.

Three of the world’s fastest-growing economies – Ethiopia, Tanzania and Rwanda – are currently located in East Africa.

In 2018, the joint gross domestic product of the Eastern African economy, measured at market exchange rates and current prices, amounted to around $342 billion.

Measured however in purchasing power parities, which arguably better reflects the size of regional economies, the regional economy is 2.6 times larger, standing at $879 billion in 2018.

If the current growth momentum is maintained, this implies that East Africa’s economy will surpass $1 trillion by 2021, making it a very sizeable market.

Intra-regional trade is believed to be a quick solution to maintaining this economic trend. Unfortunately, the levels of intra-regional trade remains very low in most countries.

Rwanda’s trade share with the rest of the continent, for instance, stood at just 28.2 per cent between 2016 and 2018.

Trends of intra-EAC trade, on the other hand, paint a sluggish picture.

Trade among the countries in the sub-region declined from 2014 to 2017. In 2013, intra-EAC exports was at $3.5 billion, but that amount had fallen to $2.4 billion by 2017.

“The full implementation of the AfCFTA could contribute to a revival of dynamism in intra-regional trade,” the report reads.

Focus on services

The AfCFTA implementation could as well result into new opportunities in high value-added services trade, which would help countries in the sub-region diversify their economies and transformation.

ECA’s assessment shows that most countries in East Africa currently post a better trade balance in services than they do in merchandise trade. Five of the fourteen countries enjoy surpluses in service trade (Djibouti, Kenya, Madagascar, Tanzania, and Seychelles).

Kenya and Tanzania, for instance, had a net service trade balance of over $1.6 billion and $2.1 billion in 2017, respectively.

The intra-African liberalization of services trade could bring great benefits to East Africa, and it is believed better access to business and financial services from across the continent could position the region on a more competitive stance.

It highlights intra-regional tourism as an example of the growing intra-regional trade in services. The sector has been gaining prominence and already constitutes 30 per cent of total international tourist arrivals in the East African Community (EAC).

However, the report says, it is the citizens of East Africa that will be the principal beneficiaries of the AfCFTA. Yet, many still face anti-competitive practices in sectors such as telecommunications, beer, cement and foodstuffs.

“Through the reduction of import prices, the harmonization of competition laws and the strengthening of regulatory rules, the AfCFTA can improve the protection of consumers and achieve a major reduction in the prices of common consumer goods and services,” the study notes.

Source: The New Times