By Our Correspondent

The Chinese regulators had launched an anti-monopoly investigation into the nation’s biggest tech company, Alibaba and its affiliate fintech Ant Group in the month of November last year.

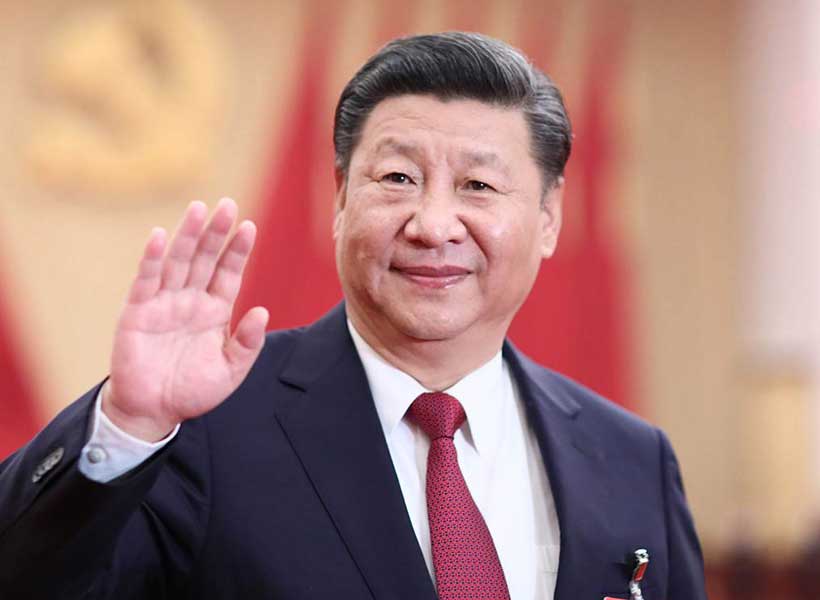

The nation’s increased scrutiny is being seen as a sense of worry by other tech giants of the country, since the Chinese President Xi Jinping, had first announced the reform through a sweeping overhaul of government administration in 2018 by newly creating, merging, and restructuring various entities to form State Administration of Market Regulation (SAMR) for extensive market controls.

The SAMR is looking over Alibaba’s practice of making sellers sign the exclusivity contracts, which mandates that sellers cannot sell their product through other platforms and has been ordered to return to its roots as a provider of payment services.

Moreover, Ant Group’s IPO, which is pre-valued at $280 billion, was at the verge of becoming the world’s biggest- ever fintech at over $300 billion, has been halted by the Chinese regulators.

It is not a coincidence that China is trying to crack co-founder of Alibaba, Jack Ma’s growing Tech Empire right after, Alibaba hit headlines when Foreign Policy revealed that China has demanded its big tech companies to process stolen US data for the nation’s intelligence agencies upon request.

In fact, Zhang Zhan an independent journalist in Wuhan was sentenced to four years of imprisonment in September after she reported that the Government was making false claims about the containment of COVID-19 virus in Wuhan and the spread has not been under control.

Moreover, a biggest real estate tycoon of China and a top member in China’s party hierarchy, Ren Zhiqiang was sentenced to 18 years of imprisonment in the same month with the charge of taking 1.25-million-yuan as bribe.

This was followed after Ren in his essay was extremely critical of Xi’s governance and management of COVID-19 virus outbreak after a televised speech by President Xi, wherein without direct claims over the President, Ren tried to compare the emperor with a clown. Shortly after the essay was published, Ren had been put under investigation for ‘suspected serious disciplinary violation’.

It is indicative of the fact that President Xi has come to enjoy Mao Zedong’s level of adulation, and any threat to his god-like image is taken very seriously with harsh punishments.

In the case of Jack Ma, in the financial year 2012, his businesses from Fintech and his traditional business of digital payment were 44% and 55% respectively, whereas, his businesses from Fintech and payments in the first six months of financial year 2020 were 63% and 36% turnover respectively.

The ongoing regulation has bogged down in between 16% to 20% of Alibaba’s value. If Jack Ma has to stop his fintech business as ordered by the regulators, then he would lose 63% of his business which had registered 60% of his growth last year.

The attack on Jack Ma indicates the concern over both his personal growth and the growth his business. The growing influence of Ma in China’s popular culture where he has an image of an all-rounder and a superstar has come to be seen as a challenge to Xi’s control over his subjects.

Jack Ma was the first Chinese person to meet Donald Trump after his election as President of USA in 2016.

Ma has, furthermore, starred in Kung-fu film as an unconquerable Kung-fu master where he portrayed an image of a Superstar, sang a song jointly with Faye Wong who is referred to as ‘diva of Asia’ in China, he has also painted ‘Paradise’ jointly with one of the famous painters of China, Zeng Fanzhi and his debut painting was auctioned for $5.4 million.

The Chinese regulators have also been pressurising Tencent games, a bigger tycoon than Jack Ma, which is also a huge investor in Indian start-ups and ventures like, Flipkart, Byju’s, Swiggy, etc.

The ever-growing worth of Jack Ma along with other more billionaires who are much more in number than both the US and India combined, has become a nightmare for Chinese policy makers who have calculated that over 60 crore population of China is living under $150 a month.

The consumption per capita has declined by 5% in China while spending on Luxury goods has risen by 50% thus widening the income inequality gap between the rich and the poor.

President Xi is striving to take China back to 1950s- style communist control. The business is allowed to grow to the extent which does not alter the Chinese Communist Party’s ego, aligns within Party’s interest and recognises the adulation of President Xi. The scholars have come to call Xi’s model of capitalism as Xi-nomics which exhibits three prominent features – tight control on economic cycle and debt machine; more affective administrative state allowing bankruptcies and patent lawsuits in orderly manner than before; and, blurring boundary between the state and private firm.

The road ahead for China through Xi-nomics is yet to be seen, but such a level of control which compromises over innovation in the economy and growth of individuals in open democratic societies is rather a model, which if succeeds, will set the wrong ever possible example for the rest of the world.