|

Getting your Trinity Audio player ready...

|

By Zimbabwe Coalition on Debt and Development (ZIMCODD)

A nation’s budget serves as a commitment by the government, and it signifies the government’s priorities over what it seeks to deliver to its citizens.

With a 927.3 billion budget against a 2 trillion ask, the Minister of Finance and Economic Development presented the 2022 budgetary framework to the nation with propositions speaking towards the different ministries and other key priorities.

The 2022 budget presents an increase of ZWL 505.7 billion from the 2021 budget which was pegged at ZWL 421.6, a difference that is difficult to conclude as commendable or an improvement given the impacts of the hyperinflation rate. For September the inflation rate was 51.55% and for October 54.49%, however, the parallel rate which is now at ZWL 200 against ZWL 105 captures what is really happening on the ground.

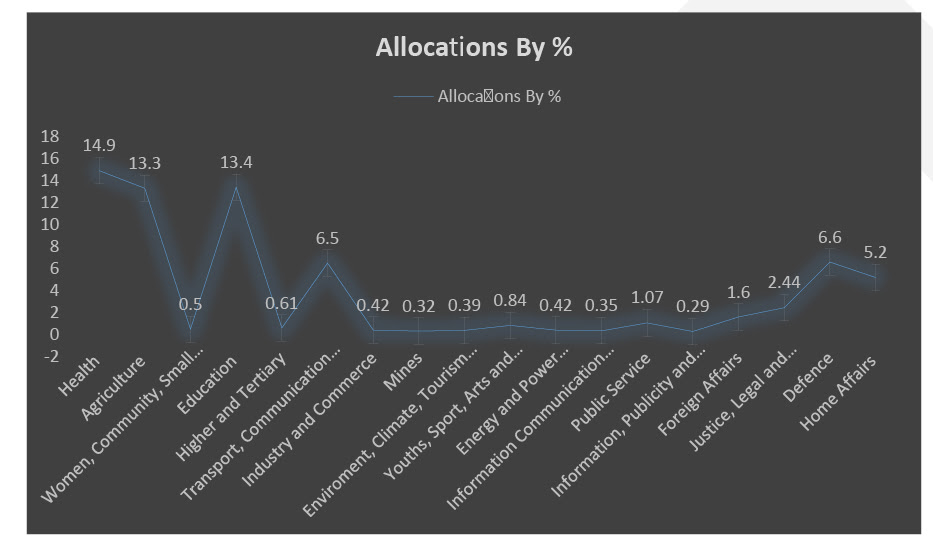

The 2022 top three allocations are to Health (14.9%); Education (13.4%); and Agriculture (13.3%) whilst the three lowest allocations are towards Information, Publicity and Broadcasting services (0.29%); Mines (0.32%); and Environment, Climate, Tourism, and Hospitality (0.39%). Further details on allocations of the 2022 budget and what it offers to the different sections of society are provided below:

2022 National Budget Allocations

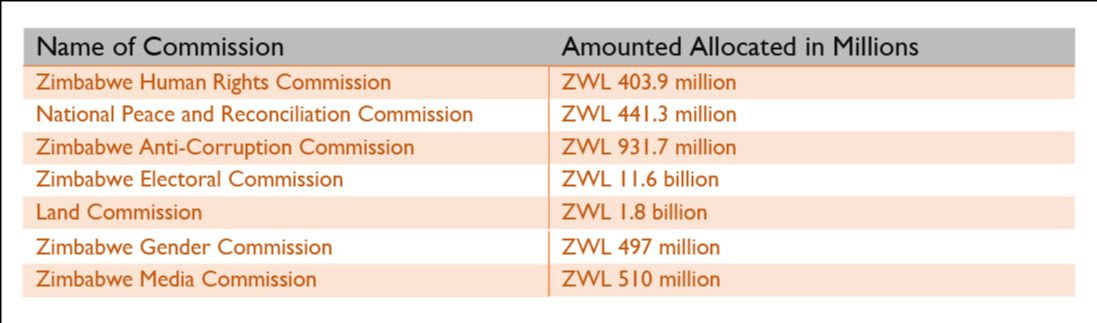

Independent Commissions

International Commitments

In terms of meeting the international commitments, the 2021 budget has done well towards Health at 14.9% against the 15% threshold of the Abuja Declaration. For Agriculture, the budget also surpassed the 10% Maputo declaration with its 13.3% allocation. The other key allocations with international thresholds are detailed below:

Debt

Public debt amounts to US$13.7 billion encompassing US$13.2 billion external and US$ 532 million domestic. Zimbabwe`s debt stock has increased by US$ 3.3 billion after the Treasury assumed the legacy debts/blocked funds held by the RBZ on its balance sheet on behalf of the Government to create a sound RBZ balance sheet. To this end, the continuous adoption or assumption of debt by the treasurer which citizens do not have the granular details about their expenditure is not only detrimental to effective public finance management but fit squarely to the concept of debt injustice whereby citizens are made to pay the debt they did not benefit from.

Conclusion

Although the 2022 national budget registered an increase of ZWL 505.7 billion from the 2021 budget which was pegged at ZWL 421.6. The budget is still lacking mechanisms for addressing inequality, this is because the Ministry of Women Affairs, Community, Small, and Medium Enterprise Development was allocated ZWL 4.7 billion a mere 0.5% of the total budget.

The bundling of the women affairs with small and medium enterprise development is problematic as it poses a challenge in expenditure tracking. Expenditure tracking is essential in ensuring effective public finance management and monitoring if the treasury is disbursing the allocated funds to responsible ministries. This is because budgetary allocation is one thing and budgetary expenditure is another.

The government has also demonstrated less commitment to devolution by allocating ZWL 42.5 billion to devolution. The national devolution allocated funds are not even double the 2022 budget proposal of Bulawayo City Council which is ZWL 26.7 billion. To this end if the government is serious about attaining vision 2030. There is a need to re-orient security service allocations considering that Zimbabwe is not at war with any nation but at war with social and economic challenges and inequalities that are affecting millions of its citizens.