|

Getting your Trinity Audio player ready...

|

The handover ceremony of the drought insurance payout cheque by the African Risk Capacity (ARC) Group signifies the nation’s resilience against climate-induced adversities.

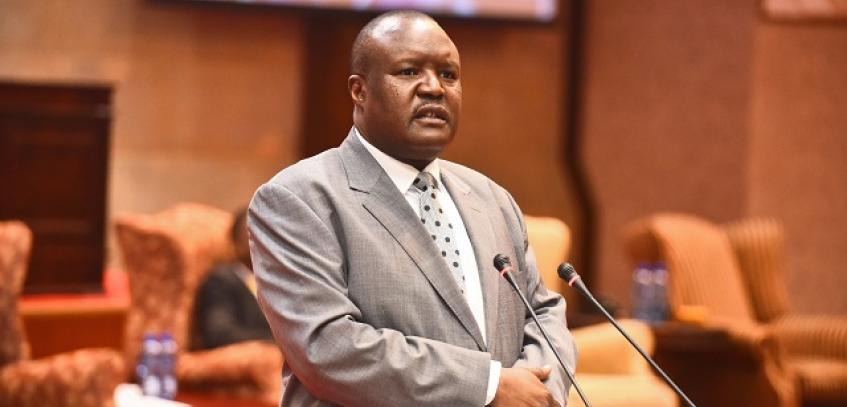

This was said by the Minister of Finance, Economic Development, and Investment Promotion, Prof. Mthuli Ncube at the occasion of the Africa Risk Capacity drought insurance payout today in Harare.

“I am very pleased to officiate at this long-awaited handover ceremony of the drought insurance payout cheque by the African Risk Capacity (ARC) Group. The payout is a result of joint efforts by the Government, UN World Food Programme (WFP), and Start Network, who participated in the sovereign insurance risk pool for the 2023/2024 agricultural season.

“This ceremony marks a monumental occasion in our endeavors to mitigate the negative impacts of drought and to solidify our nation’s resilience against climate-induced adversities,”: Minister Ncube said.

Zimbabwe became a member of the African Risk 4 Capacity (ARC) Agency in 2012. The Agency offers innovative disaster risk financing solutions and assists member states develop contingent measures for natural disasters, thus enabling countries to strengthen their disaster risk management systems, and to access rapid and predictable financing in the event of a disaster, thereby, ensuring food security and livelihoods of vulnerable populations.

This motivated Zimbabwe’s participation in the ARC drought insurance risk pool for the 2019/20 agricultural season, where it paid a premium of US$1 million towards the ARC drought insurance cover. Incidentally, the drought experienced during the 2019/20 agricultural season triggered a payout amount of $1.4 million which was extended to the Government, whilst the World Food Programme replica policy received US$ 290 000.

Over 180,000 households in the highly vulnerable districts benefitted from this payout. Since the 2019/20 agriculture season, Zimbabwe has not looked back. In collaboration with development partners namely KFW, Swiss Development Cooperation, and Africa Development Bank, the Government has been purchasing sovereign policies, complemented by Replica Policies from the World Food Programme and Start Network.

Prof Ncube announced that the United Nations High Commission for Refugees (UNHCR) has expressed interest in becoming an ARC Replica Partner for Zimbabwe, bringing the number of replica partners to three, the highest in Africa.

“Indeed, this is a welcome development, as it will increase the number of households covered under the drought sovereign policy. I am hopeful that other partners will come on board in support of our drought insurance through direct purchase or 5 the Replica approach. Today, I am honoured, to, on behalf of the Government of Zimbabwe, receive the ARC drought insurance pay-out amounting to $16.8 million. The payout is complemented by payouts to our ARC replica partners amounting to $6.1 million to the WFP and $8.9 million to Start Network. Zimbabwe will, therefore, receive a total payout of US$31.8 million. The insurance payout will be distributed to approximately 508,435 vulnerable households in 27 districts across the country, Prof Ncube added.

In his remarks on the same occasion, His Excellency Mr. Edward Kallon, UN Resident and Humanitarian Coordinator, said the cheque payout serves as a pivotal moment to underscore the compelling investment case to safeguard the indispensable role played by small farmers in achieving Sustainable Development Goals (SDGs) and mitigating the adverse effects of climate change in Zimbabwe.

Zimbabwe, like its counterparts in Southern Africa, is currently grappling with El Niño induced severe droughts. This natural disaster has impacted millions of farming households, affecting their livelihoods, food security, and economic well-being.

Small farmers and small to medium enterprises (SMEs), serving as the backbone of Zimbabwe’s agricultural sector and economy, are acutely susceptible to these environmental vagaries. The crisis underscores the critical need for robust mechanisms that shield vital sectors of society from the ravaging consequences of natural disasters.

“The Africa Risk Capacity (ARC) emerges as an invaluable instrument in this context, serving as a lifeline through timely disbursements that act as a safety net for those bearing the brunt of climate change. This assistance enables small farmers and SMEs to swiftly recuperate, facilitating their reconstruction and continuation of operations without succumbing to cycles of indebtedness and impoverishment.

“Ladies and Gentlemen: Embracing the ‘Build Back Better’ paradigm enunciated in the Sendai Framework for Disaster Risk Reduction is pivotal. By incorporating these principles, we can not only restore but enhance livelihoods and infrastructure, rendering them more resilient to future calamities,” HE Kallon said.

Given the increasing frequency and intensity of climatic shocks, he said investing in prevention, mitigation, and proactive strategies is no longer a choice but imperative. Such investments yield substantial returns by mitigating disaster impacts, safeguarding lives, and ring-fence developmental gains.

“For Zimbabwe, these investments necessitate:

- Development of Comprehensive Insurance Schemes: including expanding access to Africa Risk Insurance for small farmers and SMEs.

- Strengthening Early Warning Systems: Implementing advanced systems that provide timely alerts, enabling communities to prepare and respond expeditiously.

- Capacity Building: Equipping communities with education and training on disaster preparedness to foster resilience and the concept of risk insurance.

“Harmonizing these strategies with the broader spectrum of SDGs is paramount. Disaster risk reduction constitutes a linchpin in achieving the 2030 Agenda for Sustainable Development and its 17 Sustainable Development Goals (SDGs). Resilient agricultural practices and robust SMEs contribute significantly to multiple SDGs, namely, ending poverty (SDG 1), ending or zero hunger (SDG 2), decent work and economic growth (SDG 8), and climate action (SDG 13).”

The severe El Niño-induced drought in Zimbabwe serves as a poignant reminder of vulnerabilities. However, it also presents an occasion to fortify the national resilience framework and platform. Through adherence to the Sendai Framework principles and proactive investments in disaster risk reduction, Africa Risk Insurance can ensure that small farmers, SMEs, and the nation at large are better equipped to confront future adversities. By embracing these strategies, the Government of Zimbabwe, the UN system, and cooperating partners can safeguard progress and chart a sustainable development trajectory.

Going forward, HE Kallon said the Africa Risk Insurance Facility exemplifies the pivotal role of insurance in nurturing climate adaptation, resilience, and sustainable development within Africa’s agricultural sector. The significant economic damage inflicted by climate change on Africa in 2022, exceeding US$8.5 billion according to recent reports, underscores the urgent need for targeted climate insurance solutions and anticipatory action plans.

“Today’s ceremony underscores collective commitments to bolster resilience against climate-related hazards. By advocating for ARC’s innovative disaster risk management and financing strategies, there is scope to expand participation in ARC’s risk financing mechanisms, urge the ratification of the ARC Treaty by the Government of Zimbabwe and other governments, and showcase the efficacy of collaboration among all stakeholders involved.”