By Anyway Yotamu

The country’s biggest beverage manufacturer Delta, says it is finalising discussions with the Coca-Cola Company for the extension of the sparkling beverages franchise territory to include Manicaland and has entered an agreement to purchase the bottling assets of Mutare Bottling Company (MBC).

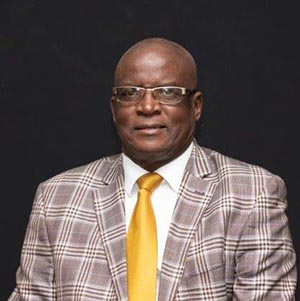

“This is a welcome development which will allow the Company to leverage on its scale and combined asset base to meet the sparkling beverages demand across the country,” said chairman Canaan Dube in a statement accompanying the group’s half year results.

In the first six months ended 30 September 2020, the group’s Lager beer volume grew 3% compared to the same period last year. This reflects a growth of 18% in Q2, reversing the sharp decline recorded in Q1 when the Covid-19 restrictions were at their peak.

Dube said the volume recovery is underpinned by competitive pricing and consistent supply.

“The volume is currently skewed in favour of the mainstream brands and larger packs due to changes in consumption occasions and settings,” he said.

In Zimbabwe, the sorghum beer volume declined by 31% compared to the same period last year due to the limited access to key trade channels such as bars, bottle stores and the rural markets during lockdown particularly in Q1.

“The value chain costs escalated more rapidly in response to the impact of the depreciating exchange rate on imported brewing cereals and packaging materials.” said Dube.

Sorghum beer volume at Natbrew Plc (Zambia) rose 8% compared to the same period last year. The nascent volume recovery, he said, is attributed to the improved appeal of Chibuku Super.

“There remains significant competitive pressure from the illegal trading in bulk beer, compromising the business recovery efforts,” he said.

The South Africa entity, United National Breweries was largely closed for the first four months as the authorities implemented very strict prohibitions on the sale and consumption of alcohol under the Covid-19 lockdown measures. Currently, alcohol sales are only permitted four days a week excluding weekends.

Sparkling beverages volume went up 22% over last year, albeit from a low base.

“The business continues to recover market share on the back of consistent product supply and competitive pricing. There was a swing in volume towards non-returnable take home packs, reflecting the reduced out of home activity due to Covid-19 restrictions.”

Afdis recorded volume growth of 15% for the six months compared to the prior year, driven by the spirits and ready to drink categories. However, there were some supply gaps arising from challenges in the logistics of imported raw materials.

Schweppes Holdings Africa reported a lower volume outturn at 18% below prior year, partly due to challenges in accessing imported raw materials and the impact of Covid-19.

“The business will benefit from improved supply of juice concentrates and the introduction of new flavours under the Minute Maid brand,” Dube said.

Zimbabwe is benefiting from the volume recovery in the beverages sectors and improved access to imported raw materials.

On the financials, inflation adjusted revenue for the first six months rose 11% to ZWL12.94 billion from ZWL11.63 billion in the prior period last year. Operating income increased by 15% to ZWL4.03 billion from ZWL3.51 billion.

After tax profit increased threefold to ZWL3.22 billion from ZWL898.21 million previously. Total assets surged to ZWL37.2 billion from ZWL30.7 billion.

The Board declared an interim dividend of ZWL45 cents per share to be paid on 17 December 2020.