By Byron Mutingwende

The launch of Econet’s “Swipe into Ecocash” facility today (Wednesday 25 October 2017) is set to improve financial inclusion among Zimbabweans battling a crippling liquidity crisis.

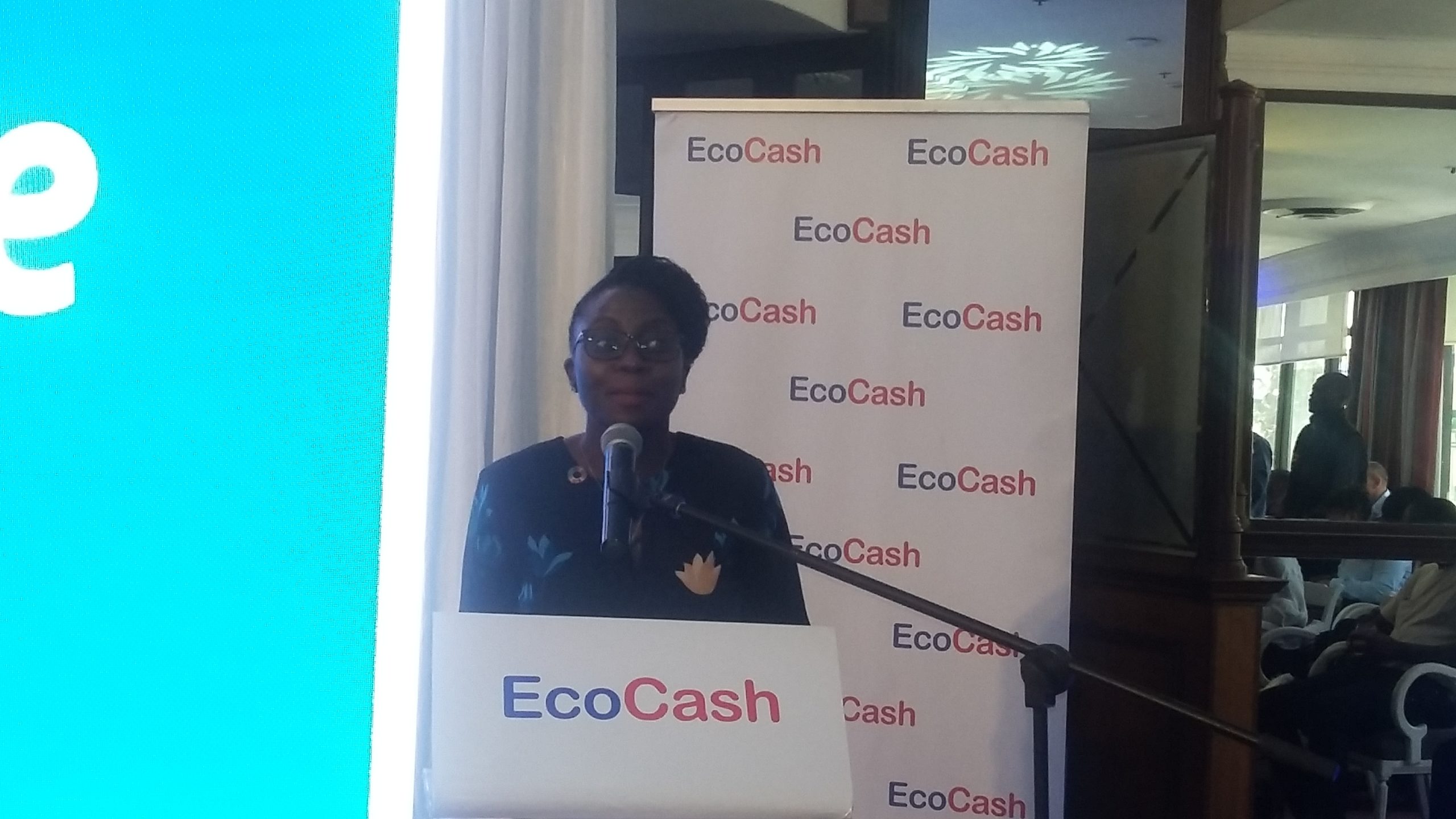

Natalie Jabangwe-Morris, the Ecocash Manager, speaking during the launch said Ecocash is indeed Zimbabwe’s largest mobile money platform, driving 98 per cent of mobile money payments and a key player in driving the country’s rate of financial inclusion now estimated to be in the region of 70 percent.

“Since Ecocash is a pivot point of financial services, we are consolidating mobile transactions across the board from retail sector, agro services to international remittances into one place. Retail giants like Delta Beverages are now on board but we are thinking beyond the borders through a micro-payment system for the mass market,” Jabangwe said.

She paid tribute to Ecocash for providing an adaptable and flexible system that has made the payroll system easy for employers and aided international remittances over the years.

“In the absence of cash, our customers have suffered. Through Ecocash, we are doing our best to address these challenges through strategic solutions. Today’s launch is beyond mobile money as we seek to provide convenience not only to our agents and merchants but to all our customers.”

Through Swipe into Ecocash, one can swipe with any ZimSwitch enabled card as long as it’s onto a Steward Point of Sale (POS) machine. One can swipe as much as $2000 per transaction. However, the number of swipes and limits depend with a particular bank’s terms and conditions. Swipe into Ecocash connects one’s bank account to his or her Ecocash account. The transaction is completed by using the bank-card PIN code. The service is available at over 5000 outlets in Zimbabwe. Ecocash according to latest Potraz report commands a humongous market share of 98 percent.

The system will deepen electronic transactions in line the Reserve Bank of Zimbabwe (RBZ)’s national payment agenda. Ecocash agents no longer need float to do transactions. The cost of doing business for agents has been reduced, prompting diverse streams of income.

Josephat Mutepfa, the director of national payments for RBZ said the new product brought convenience to the banking community, as people move away from using cash for transactions.

“This product modernises the payment system and promotes convenience. Transactions will no longer be cumbersome and time consuming. It brings efficiency, effectiveness and stability to the electronic payment systems,” Mutepfa said.

He added that it would lead to collaboration among banks and other financials service players and increase their inter-operability.