Credit rating underpinned by Afreximbank’s strong status as one of the largest Multilateral Development Banks within the African region

The African Export-Import Bank (Afreximbank), Africa’s foremost multilateral trade finance institution, announces that Global Credit Rating (GCR) has affirmed its international scale long-term and short-term issuer ratings of A- and A2, respectively, with a stable outlook. In addition, GCR has affirmed the international scale long-term issue rating on the Bank’s US$5 billion Euro Medium Term Note (EMTN) programme of A-, with a stable outlook.

GCR notes that Afreximbank’s ratings are supported by its “strong status as one of the largest Multilateral Development Banks within the African region, diverse regional membership, strong mandate and track record, demonstrated preferential creditor treatment, beyond adequate capitalization, strong risk position, diverse funding and robust liquidity.” GCR further notes that Afreximbank’s ratings also factor in the growing track record of the Bank carrying out its countercyclical role, especially in light of the current global COVID-19 pandemic and sees the Bank’s response to COVID-19, the US$3billion net Pandemic Trade Impact Mitigation Facility, as a positive proof of mandate.

GCR cites the Bank’s highly structured loan book as a rating positive, noting that “c.70% of the loan book is secured with high quality collateral comprising cash, insurance with A rated international insurers, and sovereign backed securities.” The rating agency considers the Bank’s risk positions “intact for now, despite the COVID-19 shock weighing on asset quality metrics (albeit slightly) in the short term” with credit losses comparatively favourable to rated peers and loan concentrations relatively better in comparison to other Multilateral Institutions. The Bank’s liquidity is strong, with a liquidity coverage ratio of over 149%, while liquidity is further “supported by low risk cash flows from the ring-fenced trade finance structure and a fairly good amount of liquid placements with OECD banks.”

The report notes that Afreximbank “has capacity to carry out its mandate in light of the pandemic, supported by a strong balance sheet.” Looking ahead, the rating agency expects Afreximbank’s broad geographical reach and increasingly growing membership to ensure its relevance and importance to its shareholders remains high.

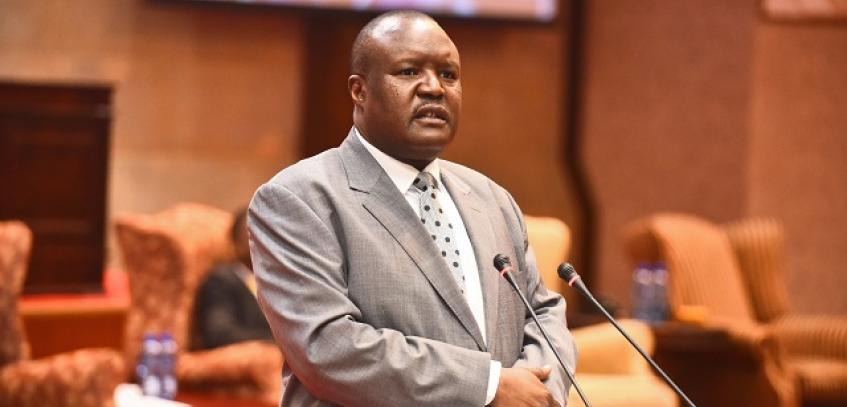

Prof. Benedict Oramah, President of Afreximbank, said:

“Afreximbank is delighted to have its strong rating affirmed by GCR. Our strong liquidity, robust management of risk and preferred creditor status all provide a firm foundation through which the Bank can deliver positive results for both our shareholders and the African nations we exist to support. This foundation has allowed us to act decisively with the Pandemic Trade Impact Mitigation Facility, our countercyclical response to the impact of Covid-19 pandemic, while also continuing to be a driving force behind the expansion of intra-African trade.”

The full GCR report can be found at: www.afreximbank.com/investor-relations/credit-ratings/