|

Getting your Trinity Audio player ready…

|

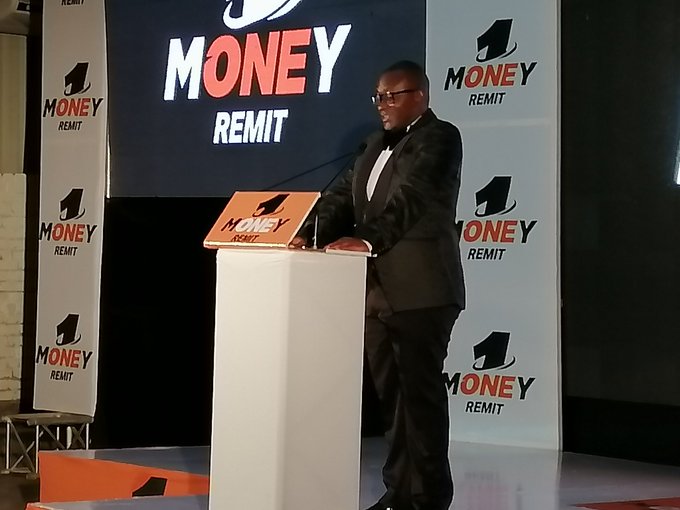

The launch of OneMoney Remit by mobile telephony giant, NetOne marks a great milestone in the country’s financial inclusion efforts, Dr. Jenfan Muswere, the Minister of Information Communication Technology (ICT), Postal and Courier Services said.

The launch yesterday was welcomed as a measure expected to ease liquidity challenges in the country since more players will promote transaction convenience.

Minister Muswere said among key goals of the new dispensation include facilitating universal access to ICTs by 2030 and developing an upper middle income economy by 2030.

“Ladies and Gentlemen, our goal is to drive a digital economy to improve the livelihoods of all Zimbabweans, regardless of location. Access to ICTs is poised to have a more profound impact on developing smart economies. Smart financial services are now at the doorstep of every Zimbabwean. My Ministry will ensure that all citizens are given the convenience that they deserve through ICT-driven financial services that deliver upon the promise of innovation.

“The National Development Strategy Number One (NDS 1) seeks to provide ICTs and digital access at village level. In support of NDS 1, our core business is to ensure that we connect the unconnected. OneMoney Remit will facilitate forex domestic remittances, from city to city, city to rural anywhere everywhere electronically through mobile devices. Our goal is to bridge the digital divide between urban and rural,” he said.

The ministry’s mandate is to fully facilitate ubiquitous connectivity through the provision of infrastructure and support systems. Towards achieving this same goal, he said NetOne complimented efforts towards the provision of mobile financial services.

NetOne Board Chairperson Ms. Susan Mtangadura said the launch of OneMoney Remit is testimony to the company’s commitment to ensure efforts to bridge the rural and urban divide.

“Information Communication Technology (ICT) is at the heart of the second Republic of Zimbabwe’s vision 2030 as an enabler for development, communication, and business investment. As a business NetOne has embraced its role to ensure financial inclusion connecting the unconnected, through the use of information technologies. With our exceptional product and service offerings, lives will be transformed and communities developed. It is without a doubt that indeed information communication technology is at the backbone of the new normal,” Ms. Mutangadura said.

Mr. Learnmore Musunda, the NetOne General Manager of Financial Services said customers in some remote parts of the country lack access to domestic remittance services hence One Money Remit comes as a panacea.

“Currently, no service currently allows customers to have USD in their mobile wallet. They are exposed to high charges which are beyond the reach of the ordinary because it is expensive to send money. That way, they are exposed to theft and loss of their hard-earned currency,” Mr. Musunda said.

OneMoney Remit allows customers to drop off cash at any NetOne Shop where they are also able to fund the wallet. They can send money to any recipient across the country.

Customers can receive and collect money across more than 40 locations in the country. One Money Remit stores value in a safe, secure platform.

Mr. Raphael Mushanawani, the netOne Chief Executive Officer said the launch of OneMoney Remit brings excitement to the market as it fulfills one of the key customer expectations since mobile financial services have become a game-changer as well as a key economic indicator.