|

Getting your Trinity Audio player ready...

|

A staggering 18,846,517 girls are out of primary school in Africa according to a new report by the Tax and Education (TaxEd) Alliance and its allies. This is against the background of losses of USD29 billion annually in education finance caused by aggressive tax avoidance by the wealthiest companies and individuals.

The Transforming Education Financing in Africa: A Strategic Agenda for the African Union Year of Education briefing reveals that sealing loopholes used for tax abuse, and ensuring fair, gender-responsive, taxation can raise an additional USD146 billion in Africa every year. An allocation of 20% (USD29.2 billion) of these additional funds to the education sector would be sufficient to cover costs for 25 million primary school children.

The report analyses the negative impact of regressive taxation policies, debt, and austerity on education funding in Africa.

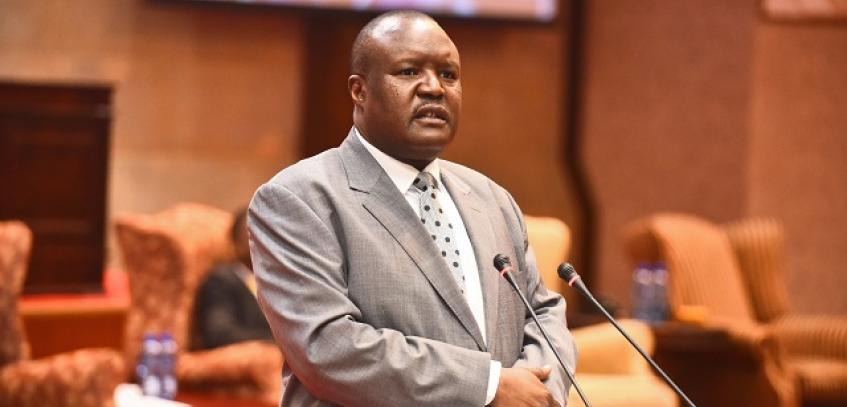

Joy Mabenge, the Country Director of ActionAid Zimbabwe, said:

“It is appalling that there are over 18 million girls missing school in Africa due to inadequate investment in the education sector when appropriate action by our governments to address gaps in taxation, debt, and austerity offers an opportunity to address this challenge.”

Additionally, the report shows that 28 of the 52 African Union countries studied are spending over 12% of their national budgets on debt repayment. 15 of these countries are already spending more on debt servicing than education.

Under the burden of the debt crisis, the International Monetary Fund has advised 96% of these countries to cut or freeze spending on public sector workers leading to cuts in salaries, and restrictions in hiring new staff, including teachers. This is likely to limit the countries’ budget allocations for education with dire consequences for learners and teachers.

Ashina Mtsumi, Coordinator of the Tax and Education Alliance, said: “Women and girls bear the brunt of austerity and debt in Africa. Evidence suggests that austerity measures often have a disproportionately negative impact on girls’ access to education, hindering their individual development and limiting their future opportunities.”

Solange Akpo, Regional Coordinator Africa Network Campaign on Education for All

(ANCEFA), said: “Decisive action is required on tax, debt, and austerity to transform education financing across Africa and to get the ball rolling towards inclusive and gender transformative education.”

Aya Douabou, Programme Officer for Africa at the Global Initiative for Economic, Social and Cultural Rights (GI-ESCR), said: “This briefing paper is highly timely and relevant as it proffers solutions to African States in helping them fulfil their human rights obligation to sustainably finance public education for all.”

Dennis Sinyolo, Africa Director at Education International, said: “African governments should take immediate policy, legislative, and financing measures to end the teacher shortage. We call on AU member states to ensure that every African child is taught by a qualified, supported, and motivated teacher with decent salaries and working conditions”.

The briefing urges African countries to strengthen sustainable, gender-responsive domestic financing for education by leveraging fair and progressive taxation, ending austerity, and insistence on urgent debt relief and much-needed reform to the global debt architecture.

ENDS

To contact the ActionAid Press Office email [email protected] or +263776665065.

Spokespeople available

- Joy Mabenge is the Country Director of ActionAid Zimbabwe and is based in Zimbabwe.

- Wangari Kinoti is the Women’s Rights and Feminist Alternative Lead at ActionAid International and is based in Nairobi, Kenya.

- Ashina Mtsumi, is the Coordinator of the Tax and Education Alliance and is based in Nairobi, Kenya.

- Julie Juma, Education Out Loud (EOL) Programme Manager, Global Campaign for

Education

Notes to Editor

The Tax and Education Alliance brings together in partnership tax justice and education actors at national, regional and global levels to make a transformative breakthrough in the domestic financing of public education, while ensuring the resources are raised and spent in a sustainable, progressive and gender-responsive way.

The list of organisations that have endorsed the report:

- ActionAid

- Africa Network Campaign on Education for All (ANCEFA)

- Centre for Economic and Social Rights (CESR)

- Education International (EI)

- Global Alliance for Tax Justice (GATJ)

- Global Campaign for Education (GCE)

- Global Initiative for Economic, Social and Cultural Rights (GI-ESCR)

- Government Revenue and Development Estimations (GRADE) – University of St Andrews

- Initiative for Social and Economic Rights (ISER)

- Tax and Education (TaxEd) Alliance

- Tax Justice Network (TJN)

- Tax Justice Network – Africa (TJNA)

About ActionAid

ActionAid is a global federation working with more than 41 million people living in more than 71 of the world’s poorest countries. We want to see a just, fair, and sustainable world, in which everybody enjoys the right to a life of dignity, and freedom from poverty and oppression. We work to achieve social justice and gender equality and to eradicate poverty.