Despite a high-cost environment compared to its peers in the region, Pretoria Portland Cement (PPC) Zimbabwe is taking measures to protect profitability amid rising operational costs.

This emerged at a press conference in Harare on 29 November 2024 where the cement giant’s management revealed that it recently released its half-year results.

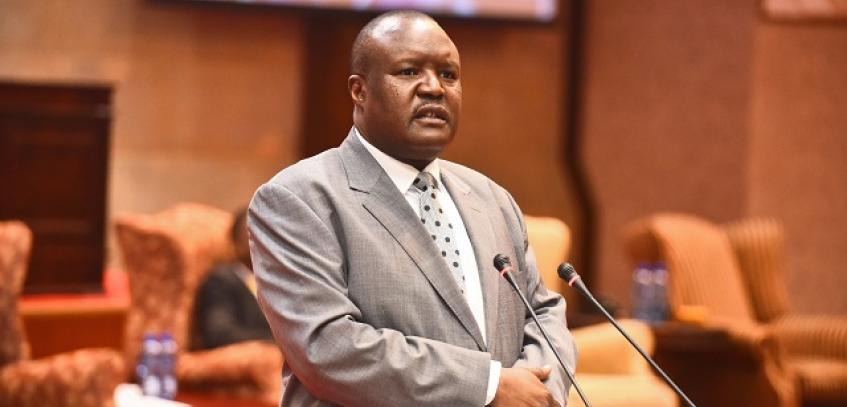

Addressing journalists, Albert Sigei, PPC Zimbabwe’s Managing Director shared highlights on the industry and business during the first half of the company’s current financial year.

Sigei said PPC Zimbabwe continues to play a pivotal role in the country as it pursues its mission of empowering people to experience a better quality of life while supporting the country in pursuit of Vision 2030 objectives.

“To this end, PPC Zimbabwe made a solid contribution by supplying more than 50% of the country’s cement requirements, including the supply to major infrastructure projects such as the Mbudzi interchange and the various dams and roads projects that were carried out by the Government. We are pleased to inform you that PPC Zimbabwe maintained adequate sufficient supplies to the market during the period with cement stock cover days being above 40 days for most of the period.

“This allowed us to complete our annual maintenance in September 2024 without affecting product supplies to the market. This has been made possible through the dedicated input of our staff and business partners to whom we are grateful,” Sigei said.

At an industry level, the local cement manufacturers have more than sufficient installed cement grinding capacity to meet the country’s demand.

Zimbabwe’s installed capacity is just over 3 million tons versus annual demand estimated at 1,8 million tonnes. PPC Zimbabwe’s cement grinding capacity is 1, 4 million tonnes.

Among the challenges is a massive influx of imports into the country. Sigei estimates that the country will unnecessarily lose over 50M USD of scarce foreign exchange annually if firm action to curb the imports is not taken. He said the imports enjoy an unfair playing field compared to local players, considering that importers have not made any investments, and this could ultimately lead to a slowing down of local manufacturing, leading to job losses as cement grinding capacity utilization becomes low.

Other challenges faced by the industry include a high-cost environment compared to peers in the region, especially the cost of power, transportation, and manpower. For example, the power tariff increased by 76% compared to the same period in the prior year. Electricity supply quality also remains an important issue leading to 408 hours of unplanned production stoppages over the last 12 months. These challenges were exacerbated by recent policy changes that hurt PPC Zimbabwe sales, coupled with difficulties emanating from local currency stability.

Sigei reported that the first half of the financial year for PPC Zimbabwe was a difficult period with revenues recording a decline of 9% versus the prior year. This was primarily due to the influx of imports that were not allowed into Zimbabwe in the comparative period. A rigorous cost savings program was therefore implemented by the Company to counter the lower revenues. This resulted in Earnings Before Interest Tax and Armortisation (EBITDA) dropping by a lower rate of 4% and an improvement in EBITDA margin by close to 2%.

Going forward, the company expects to face a rapidly changing business environment with intensified competition including an influx of cement imports and threats of new entrants into the market.

The cement industry will continue to be challenged by the significant cost escalation on critical cost drivers such as electricity, input materials transportation, and manpower. As a result, PPCZ promised to continue implementing its program to optimize costs and improve efficiency to recover profitability to the prior year’s level by the end of the financial year. Areas covered under the program include the cost of key inputs, transport costs, fixed costs, and overheads on top of an enhanced focus on operational efficiency and innovation.

As part of the strategy, PPC Zimbabwe considered retrenchment of some employees who were in positions that would have become redundant after the implementation of a simplified organizational structure. This option was however not implemented and other cost containment measures favoured instead, considering the economic environment in Zimbabwe and the impact on employees.

Sigei said the measures being taken by the company are important for profitability improvement and to secure PPC Zimbabwe’s sustainability into the future.

“While we have maintained uninterrupted supplies to the country from our Colleen Bawn, Bulawayo, and Harare factories, power supply remains a major threat. For example, we had close to 4 electricity supply-related stops every month in our Colleen Bawn plant. This resulted in about 180 hours of lost production, equivalent to 20,000 tonnes of clinker with an adverse financial impact of more than 1 million USD. The Company continues to engage ZETDC to address the incessant power challenges. We are also accelerating our 20MW and 10MW solar projects at Colleen Bawn and Bulawayo Factory under a Power Purchase Agreement model.”

As part of its corporate social responsibility, the PPC Zimbabwe continues to focus on the areas of education, health, economic development, and environment. During this calendar year, PPC Zimbabwe handed over a fully equipped science laboratory block in Bengo, Matabeleland South, and a classroom block to the community in Mundimu, Shamva. Through its contribution to the Gwanda Community Share Ownership Trust, the Company partnered with JR Goddard in the construction of Gungwe Dam in Matabeleland South. Gungwe Dam was destroyed by Cyclone Eline in 2016. The project is ongoing and is almost complete.

Sigei said despite the challenges, the future of the Company remains solid with a robust strategy, clear initiatives to address emerging challenges, a strong legacy brand, a highly skilled workforce, and excellent support from its shareholders and Board.

“I would like to take this opportunity to thank our Shareholders and Directors for their continued support of the business. I would also like to sincerely appreciate our employees for being the pillars of the success of PPC Zimbabwe. Their continuous hard work and commitment to PPC Zimbabwe’s vision has been exceptional. PPC Zimbabwe cannot thrive without the continuous support of the Government and other key stakeholders – their valuable contribution is greatly appreciated. Lastly and most importantly I would like to sincerely thank our valued customers for the support they continue to give us every year. Together we are stronger,” he added.