By GERALD ANDAE – Business Daily

All has not been with Africa’s trade fabric amid standoffs over market access.

For example, Kenya’s milk has had difficulties over time in accessing the Zambian market, while the actual sell-by date of the Kenyan tea has been a subject of controversy in Sudan because of different standards.

And as the heads of state meet this Friday in Niger for the first extraordinary meeting of the African Continental Free Trade Area (AfCFTA), the standard differences will remain to be the elephant in the room on implementation of the pact.

Zambia rejected Kenya’s milk more than a decade ago, saying it has a level of bacteria that’s beyond the country’s required maximum.

Zambia allows total bacteria count (TBC) of 200,000 while Kenya follows the international benchmark of one million TBC.

These differences in standards applied by member states can dampen a noble idea on the free movement of goods and services in the continent.

Harmonising standards

In light of this, World Trade Organisation (WTO) and Common Market for Eastern and Southern Africa (Comesa) have started harmonising standards to break the bottlenecks that might hinder free trade of goods among member states.

Kenya is the second country after Uganda, to start implementing the project with the inception meeting and high-level stakeholder dialogue that took place last week in Nairobi.

The project, titled ‘Mainstreaming Sanitary and Phytosanitary Standards (SPS) Capacity Building into the Comprehensive Africa Agriculture Development Programme and other National Policy Frameworks to Enhance Market Access,’ (P-IMA) aims at harmonising different standards in the continent.

Standards and Trade Development Facility, an agency of the WTO, supports the programme.

The P-IMA framework is an evidence-based approach to inform and improve SPS planning and decision-making processes. It helps to link SPS investments to public policy goals including export growth, agricultural productivity, and poverty reduction.

According to a joint study the East African Business Council and Botho Emerging Markets Group, AfCFTA and Tripartite Free Trade Area (TFTA) conducted, each has the potential to transform the operating and commercial environments for East African businesses.

Uncertainty

Under AfCFTA, the coverage of products with zero-rated duties is not targeted at 100 percent as each customs union will set 90 percent of goods to be zero-rated with the remaining 10 percent to be categorised under sensitive goods.

“Currently, it is not known which products will be classified as sensitive and exempt. This means a high degree of uncertainty exists over the tariff changes for those goods, which might be traded more on the continent, and when this change might happen,” says the report.

The East African Community’s (EAC) draft tariff offer to continental counterparts suggests that goods currently most protected under the bloc’s common external tariff will be exempt from duty reductions.

Under the AfCFTA regime, transition periods depend on the economic development of each country.

For Middle-Income Countries (MICs), the 90 percent zero-rated tariff lines would be phased in more than five years and sensitive goods over 10 years.

For the Least Developed Countries (LDCs), the periods would be 10 and 13 years respectively.

With mixed membership to different economic blocs, it is not yet clear whether the EAC will take the status of Middle-Income Countries or Least Developed Countries.

Variation of standards

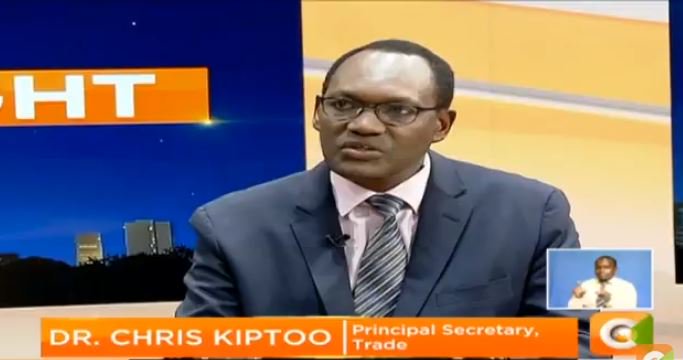

Trade PS Chris Kiptoo says the variation of standards in the Comesa countries and the continent undermines the region’s capacity to trade with itself.

“The diversity of strengths and weaknesses on the continent demands greater collaboration between countries that belong to the same Free Trade Area,” he says.

Dr Kiptoo says compliance with standard measures opens export opportunities for producers and exporters, at the intraregional and international levels.

Comesa Director of Agriculture and Industry Thierry Kalonji attributed bottlenecks on regional trade to a lack of industrial diversification, the existence of non-tariff barriers (NTBs) such as health standards requirements, supply-side constraints and cumbersome border measures.

“Almost 70 percent of the reported NTBs in the region are constituted by technical barriers to trade (TBTs) and SPS measures,” he said.

“If they are not addressed, our countries will find it difficult to take advantage of the mega-trade agreements such as the tripartite and the continental free trade area.”

The AfCFTA attained the requisite ratifications after 22 member states, endorsed the agreement to enter into force, which became effective on May 31.

Trading barriers

Regional business blocs such Economic Community for West Africa, Southern African Development Community and the EAC will have to fit into a larger continental body (AfCFTA), which now breaks the boundary barrier on trading.

The Tripartite Free Trade Area, which was to bring together the three continental bodies, is yet to secure the requisite number of countries in order to make it effective.

So far, the TFTA has secured only four of its required 14 ratifications for enforcement with the deadline having lapsed in April.

The countries that have ratified include Kenya, Egypt, South Africa and Uganda.

Source: Business Daily