|

Getting your Trinity Audio player ready...

|

The Confederation of Zimbabwe Retailers (CZR) is crying foul over a recent letter in which Finance and Economic Development Minister Prof Mthuli Ncube insisted that retailers should pay Value Added Tax (VAT) on rice for periods backdated to 2017 on packages of 25kg or less.

In the letter, Prof Ncube said Treasury could not accede to CZR’s request for a “retrospective exemption of rice from VAT” implying that outstanding VAT remains due and payable.

“As the Confederation of Zimbabwe Retailers (CZR), we are shocked that Prof Ncube is plunging headlong with his views that VAT should be backdated to 2017 without looking at the ramifications such a directive would have on the economy which is slowly opening up after taking a battering from the Covid-19 pandemic.

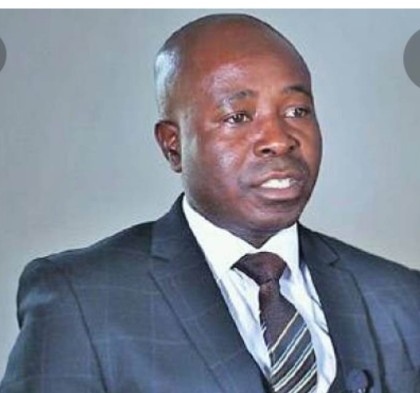

“As Adam Smith argued in his seminal book, The Wealth of Nations, taxation should follow the four principles of fairness, certainty, convenience, and efficiency. The backdating of VAT to 2017 does not follow any of the principles. It is clear now that Treasury wants to collect money at whatever costs and does not believe that companies need to be nurtured post-Covid-19 lockdowns so that they are on a better keel to be able to contribute more in taxes,” Mr. Denford Mutashu, the CZR president said.

Consumers have enjoyed price stability and there are fears that the VAT decree will upset the applecart.

The Consumer Council of Zimbabwe was recently quoted fearing a round of price increases if the government is adamant that the VAT is backdated to 2017.

They are not the only constituency that will be affected. The whole rice value chain will catch a cold. Those involved in supply, distribution, and packaging will feel the heat.

Some CZR members have warned that they will close shop as they cannot bear the burden.

If they were to close, the action will hurt business confidence.

It will also reverse the gains made since the ushering in of the New Dispensation in November 2017 with President Emmerson Mnangagwa expounding the “Zimbabwe is open for business” mantra.

The New Dispensation has placed focus on private-sector-led growth with the government’s role premised on providing an enabling environment for business to thrive.

The previous administration was accused of policy inconsistencies and there is fear this tax issue would be seen as taking the new administration to the old way of doing things.

CZR pledged to continue dialogue with authorities until a win-win solution has been found.

“We are committed to the development of the economy and support H.E. Mnangagwa’s vision of transforming Zimbabwe into an upper-middle-income economy by 2030,” Mr. Mutashu said.

The CZR has since approached the President’s Office, the Ministry of Industry and Commerce, and other high-ranking officials to register their displeasure with the order to pay VAT for rice in retrospect.

By way of the factual background, in terms of Statutory Instrument 273 of 2003, all rice products were standard rated for VAT. In 2008, this position was changed so that all rice (whether semi-milled or wholly milled, broken, in the husk or without, and no matter the size of packages), was zero-rated for VAT under Statutory Instrument 110 of 2008.

In 2016, there was a differentiation in the VAT categorisation of rice, in that rice was exempt from VAT, save for semi-milled or wholly milled rice in bulk (tariff code 1006.30.10), in packages of 25 kilogrammes or more, and all broken rice (tariff codes 1006.40.10 and 1006.40.20) were zero-rated for tax.

Thereafter, on 1 February 2017, the position was changed through the introduction of Statutory Instrument 20 of 2017, whereafter all rice was standard rated for VAT, save for semi-milled or wholly milled rice in bulk, in packages of 25 kilogrammes or more (tariff code 1006.30.10), and all broken rice (tariff codes 1006.40.10 and 1006.40.20) which remained zero rated.

There was general concern from the public regarding the imposition of VAT on basic goods, which led to the then Minister of Finance, Mr. Patrick Chinamasa, making a statement in Parliament to the effect that: “I propose to shelve the implementation of Statutory Instrument 20 of 2017, which levies VAT on potatoes, rice, margarine, maheu and meat products”.

Further to the above, the Ministry of Finance thereafter issued a statement in which retailers, including CZR, and members of the public were advised that:

“Following the Hon. Minister’s review of this policy stance, Treasury is, thus, gazetting a new Statutory Instrument to exempt from VAT products which include beef, chicken and fish as well as rice, potatoes, margarine, and mahewu.

The Statutory Instrument takes effect from 16 February 2017, and all traders in such products should no longer charge VAT on the following items:

Beef;

Chicken;

Fish;

Rice;

Potatoes;

Margarine; and

Mahewu.

Consumers should, therefore, not be made to pay VAT on beef, chicken, fish, rice, potatoes, margarine and mahewu, effective from 16 February 2017”.

CZR acknowledges that such statements do not constitute a law, but are useful in demonstrating the intention of the executive and legislature.

Following the statements, however, on 16 February 2017, Statutory Instrument (SI) 26A of 2017 was then promulgated, and materially, at Section 2 thereof, SI 20/2017 was repealed. The effect, therefore, was to revive the position as set out in SI 9/2016. It is, therefore, CZR’s position that VAT on rice was only chargeable in the period between the promulgation of SI 20 of 2017 and SI 26A 2017 – a period of 16 days.

For purposes of clarity, the position is as follows:

| Tariff Code | SI 273/2003 | SI 110/2008 | SI 09/2016 | SI 20/2017 | SI 26A/2017 |

| 1006.10.10 (rice in husk, in bulk >25kgs) | Standard rated at 15% | Zero rated | Exempt | Standard rated at 15% | Exempt |

| 1006.10.20 (10.90) (In husk, pre-packed , 25kgs) | |||||

| 1006.20.10 (husked, in bulk >25kgs) | Standard rated at 15% | Zero rated | Exempt | Standard rated at 15% | Exempt |

| 1006.20.20 (20.90) (husked < 25kgs) | |||||

| 1006.30.10 (semi-milled or wholly milled, in bulk >25kgs) | Standard rated at 15% | Zero rated | Zero rated | Zero rated | Zero rated |

| 1006.30.20 (30.90) (semi-milled or wholly milled <25kgs) | Exempt | Standard rated at 15% | Exempt | ||

| 1006.40.10 (broken in bulk >25kgs) | Standard rated at 15% | Zero rated | Zero rated | Zero rated | Zero rated |

| 1006.4020 (40.90) (broken <25kgs) |

It is therefore CZR position, that in terms of the law, all rice – including rice packaged in packages of 25 kilogrammes or less is VAT exempt.

The retailers’ concern remains that the backdating of the returns will have huge operational implications for business. The only way the industry will be able to pay the VAT is if they pass the cost to the consumer through price increases. The VAT levied on the product will render the product unaffordable and severely affect the very poor.

“In this era of relative price stability, this will not be a desirable outcome. We believe that rice is basic food and it should remain exempt, as it is the only viable substitute for maize meal. Even in the event that the price of rice is increased, payment of the uncollected VAT may take years, and some retailers will simply be unable to make the required payments and will be forced to liquidate.

“Furthermore, there is a misconception that the measure supports the local packaging industry. It, in fact, has the exact opposite effect. Rice in smaller pre-packs will be at a much higher price than rice in bulk packs. This will encourage sales of rice in larger pack sizes and risks many jobs in the local packaging industry. There will be a shift in sales from formal retailers who are tax compliant to informal traders. The effect will be to further informalize the economy as well as de-industrialize the sector. As VAT is not charged on rice in neighbouring countries such as South Africa and Mozambique, cross-border traders will exploit arbitrage opportunities and further affect the formal businesses. This is tantamount to “killing the goose that lays the golden egg” and will adversely affect the fiscus in the long run. The different VAT status of broken and non-broken rice creates further complications as distinguishing between the two is very difficult and creates further loopholes in compliance.”

The proposed VAT on small pre-packs is also described as a retrogressive tax as it affects the very poor who can only afford to buy small pre-packs, Higher income earners will simply purchase rice in packages of 25 kilogrammes and more, and will and not pay the VAT.

The position taken by the Ministry of Finance has adversely affected confidence amongst retailers, such that some have started applying higher margins to cater for any potential legal costs. Furthermore, there is fear that the Ministry of Finance will pursue other products that were included in SI 20 of 2017, such as margarine, maheu, and potatoes, all of which are not mentioned in Section 3 of SI 26A of 2017 (as they were already exempt by virtue of SI 9 of 2016, as is this case in respect of the initial rice tariffs).

After the publication of SI 26A of 2017, multiple audits were carried out by ZIMRA and the VAT issue was not raised by ZIMRA. If VAT was meant to be charged in terms of law, ZIMRA and/or the Ministry of Finance ought to have taken action to ensure that VAT was paid. Instead, the status quo was retained, and members could only assume that ZIMRA was (correctly) of the view that rice was VAT exempt. The complete turnaround in the position which the retailers, wholesalers, and consumers in Zimbabwe believed to be in place – namely that all rice was VAT exempt, more than 3 years later, would contravene the contra fiscum rule.