By Zimbabwe Coalition on Debt and Development

The Zimbabwe Coalition on Debt and Development convened a virtual Public Finance Management Reform Indaba to reflect on the Monetary Policy Statement presented to the nation by the Governor of the Reserve Bank of Zimbabwe (RBZ) on 18 February 2021. The following are ZIMCODD’s critical reflections, analysis and recommendations:

- The Governor of the RBZ, Dr John Mangudya presented the 2021 Monetary Policy Statement (MPS), under the theme “Staying on course in fostering price and financial sector stability”. It outlined a number of contractionary policy measures aimed at resolving the instability of the ZWL currency and stabilising the financial sector. In our view, these ambitions must be subordinate to the more pressing need for an expansionary Monetary Policy aimed at putting more money into the pockets of Zimbabwe’s working poor. An estimated 70% productive Zimbabweans earn their livelihoods from the informal sector whose performance has been shrunk by the COVID-19 pandemic and the associated lockdowns. The distributional consequences of Monetary Policy measures must therefore allow farmers, Small to Medium Enterprises and Small Scale and Artisanal Miners access to borrow at reasonable rates and transact with adequate liquidity.

- A lot hinges on currency stability. To this end, the Bank underscored its commitment to address the runaway inflation by reducing the Reserve Money growth target from 25% – 22.5% per quarter. Already 22.5% monetary growth per quarter is a high figure considering that the achieved growth of 21% has resulted in an inflation rate as high as 830% in August 2020. To put this into context, the 2020 Monetary Policy Statement set the annual target at between 10% – 15%. The revised target though an indicator of things moving in the positive direction will only stimulate market confidence if accompanied by results. Past performance has given the nation little reason to invest much confidence in Bank’s efforts to address money supply growth.

- There is need for policy measures to promote long-term lending to stimulate local economic sectors including the informal sector where the majority of Zimbabweans find their livelihoods. At present, the loan to deposit ratio currently below 40% indicates that there is money sitting in banks and not stimulating production. By increasing statutory reserves from 2.5% to 5% for demand/call deposits and maintain the statutory reserve for time deposit at 2.5% the MPS effectively reduces the pool of available loanable funds to support economic stimulus. This does not imply that most productive actors have either the capacity or requirements to take on new debt as many do not, however there is urgent need for more innovative measures to inject liquidity in the economy and provide working capital.

- The MPS efforts to fix money supply growth counteract the urgent need for economic stimulus to jumpstart the economy and ease the transition from lockdown. Increases to the bank policy rate for overnight lending from 30% to 40%, and the medium-term lending rate for the productive sector from 25% to 30% inadvertently make it more difficult to access liquidity on the local market. These measures by making the cost of borrowing more punitive are expected to tighten local currency liquidity in the market and discourage speculative borrowing. The negative side effects of these measure will result in a stalled economic rebound as many companies will struggle to access capital for production. In-turn many households and local businesses will be forced to resort to exploitative debt arrangements through poorly regulated or unregistered loan companies thus expanding an already worrisome local debt crisis.

- Long overdue directive for banking institutions to pay interest on deposits must be accompanied by stronger regulation and consumer protection mechanisms to regulate banking and mobile banking transaction charges. The MPS rightly compels banks to pay interest on deposits as a way of building confidence in the local currency and in compliance with the Banking (Savings Interest Rates) Regulations, SI 65A of 2020, which requires every banking institution to pay interest on all type of deposits. However, the obtaining inflationary environment defies negative interest on deposits. Also, the inflationary pressures on static salaries and low incomes discourages saving and incentivises the preference for remuneration and payments in the more stable US Dollars.

- The gap between the formal and informal exchange rates currently estimated at 40% is a worrisome indicator of the limitations of the Foreign Currency Auction System. However, to its credit, the Auction System has doubled the amount of foreign currency allocated from about $15 million in June 2020 to US$30 million January 2021. Several gaps including reducing the time it takes to access the foreign currency require attention. So too does the need for meaningful deterrents against companies selling money accessed at lower rates on the Auction at higher rates on the informal market. The 40% export surrender requirement, 20% domestic foreign exchange sales proceeds surrender requirement and 15% foreign exchange contribution from the fiscus outlined in MPS are a welcome boost to the Auction System.

- Government’s allocation of 15% foreign exchange contribution from the fiscus to boost the Auction System is a pragmatic move that demonstrates the need to align fiscal and monetary policy to achieve common objectives. In this time of COVID-19 economic hardships, it would have been desirable for Central bank to create new money through quantitative easing to finance government stimulus spending to boost local production and create jobs. This will not be possible under present circumstances and within the limitations imposed on our fiscal and policy space. To promote innovation, long-term and responsive policy mechanisms necessary to respond to the economy and the pandemic there is need for a stable currency, shared economic vision and democratic safeguards.

- The increase in withdrawal limits and introduction of higher denomination notes is a welcome move to increase consumer and traders’ convenience. Difficulties in accessing cash have had a disproportionate negative impact on rural communities and the informal sector as they rely on cash for daily transactions, transport and commerce. Cash challenges inhibit trade and increase the cost of goods and services as consumers are penalised for failing to access cash. As long as cash transactions remain cheaper compared to electronic transfers, Bank queues will remain a permanent feature. Higher denominations and withdrawal limits are therefore inadequate without long overdue reforms to consumer banking and consumer safeguards to regulate mobile money banking charges.

- Unprecedented times call for unprecedented measures. Although Monetary Policy measures alone cannot address the economic challenges confronting Zimbabwe, a more radical approach to policy making can go a long way. A narrow focus on currency stability and inflation targeting is dwarfed in perspective by the expressed needs in Zimbabwe’s real economy for liquidity and pathways out for perpetual lockdowns. The Reserve Bank’s responsibility to ensure the integrity and stability of the nation’s financial system mandates it to direct its regulatory powers to address existential threats to Zimbabwe’s economy such as the daily struggles experienced by 70% of the population to access the resources to make a meaningful contribution to the economy.

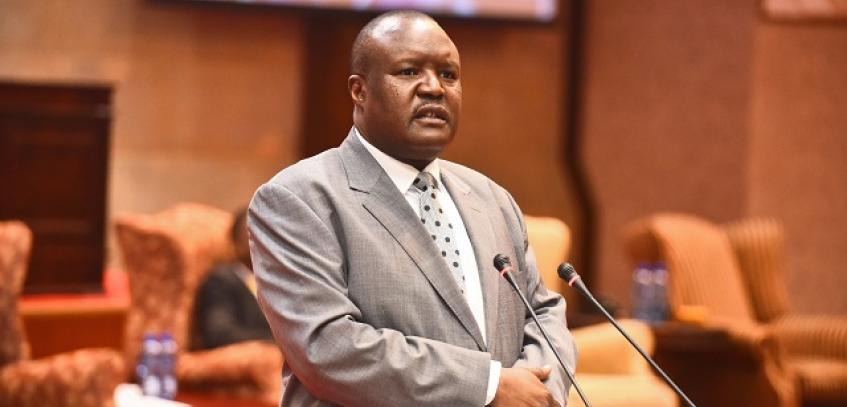

ZIMCODD is indebted to the esteemed Public Finance Management Reform Indaba panel of TafadzwaBandama (Chief Economist with the Confederation of Zimbabwe Industries), Hon. Dr Tapiwa Mashakada (Economic Advisor Movement for Democratic Change-Tsvangirai) and Hon Willias Madzimure (Member of the Portfolio Committee on Budget, Finance and Economic Development). ZIMCODD is grateful to the Social and Economic Justice Ambassadors, Coalition Members and citizens who contributed their views. ZIMCODD thanks Mr Andy Hodges for hosting the engagement and to the Zimbabwe Television Network for broadcast services.