|

Getting your Trinity Audio player ready...

|

By Joyce Mukucha

The Food and Agriculture Organisation (FAO) has recently announced that the UN barometer of world food prices has surged to a new peak, reaching its highest level since July 2011.

The FAO Food Price Index, which tracks the international prices of a basket of food commodities, is up 3.9 per cent from September, rising for a third consecutive month.

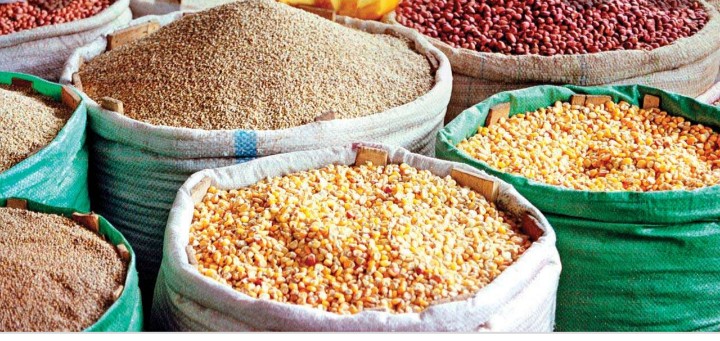

According to FAO, cereal prices overall increased by 3.2 per cent, with wheat rising five per cent, due to reduced harvests in major exporting nations, including Canada, Russia and the United States highlighting that prices of all other major cereals also increased.

“The FAO Cereal Price Index averaged 137.1 points in October, up 4.3 points (3.2 percent) from September and 25.1 points (22.4 percent) above its level one year ago. International prices of all major cereals increased month-on-month. World wheat prices continued to surge for a fourth consecutive month, rising by a further 5 percent in October, to stand 38.3 percent higher year-on-year, and reaching their highest level since November 2012.

“Tighter availability in global markets due to reduced harvests in major exporters, especially Canada, the Russian Federation and the United States of America, continued to put upward pressure on prices. Reduced global supplies of higher quality wheat, in particular, exacerbated the pressure, with premium grades leading the price rise,” FAO highlighted in a press release.

As for cereal output record, FAO has it that compared to last year, global cereal production for 2021, is anticipated to increase and reach a new record level, of some 2,793 million tonnes.

It indicated that world cereal consumption for 2021/22 is heading towards a 1.7 per cent gain, led by an anticipated increase in global food consumption of wheat, rising in tandem with a growing global population.

The organisation pointed out that among coarse grains, international barley prices increased the most in October, underpinned by strong demand, reduced production prospects and price increases in other markets.

“World maize prices also firmed, supported by gains in energy markets. However, increased seasonal supplies and easing of port disruptions in the United States of America limited the increase in maize values. International rice prices also edged up further in October, although the onset of main crop harvests in various Asian suppliers capped the increases,” FAO added.

Concerning the vegetable oil, FAO stated that index went up 9.6 per cent, hitting an all-time high, and dairy rose by 2.6 points, with increased demand for butter, skimmed milk powder and whole milk powder, as buyers try to replenish low stocks. By contrast, cheese prices remained stable.

“The FAO Vegetable Oil Price Index averaged 184.8 points in October, up 16.3 points (or 9.6 percent) month-on-month and marking an all-time high. The increase was driven by firmer price quotations for palm, soy, sunflower and rapeseed oils. International palm oil prices increased for a fourth consecutive month in October, largely underpinned by persisting concerns over subdued output in Malaysia due to ongoing migrant labour shortages.”

In the meantime, world prices of palm, soy and sunflower oils received support from reviving global import demand, particularly from India that lowered import tariffs further on edible oils.

As for rapeseed oil, the continued strength in international values chiefly stemmed from protracted global supply-demand tightness. Noticeably, rising crude oil prices also lent support to vegetable oil values.

For dairy, the FAO Price Index averaged 120.7 points in October, up 2.6 points (2.2 percent) from September and 16.2 points (15.5 percent) above its level in the corresponding month a year ago.

In October, international price quotations for butter, skim milk powder and whole milk powder rose steeply for the second consecutive month, underpinned by firm global import demand amid buyers’ efforts to secure supplies to build stocks. By contrast, FAO pointed out, cheese prices remained stable.

“Seasonally low milk supplies and tight inventories in Europe and a slower start than earlier anticipated to the new milk production season in Oceania also lent support to world milk prices. By contrast, cheese prices remained largely stable, as supplies from major producers were adequate to meet global import demand.”

For the third consecutive month, FAO said, the meat index declined, amid reduced purchases of pork products from China, and a sharp decline in beef from Brazil. Poultry and sheep prices rose.

“The FAO Meat Price Index averaged 112.1 points in October, down 0.8 points (0.7 percent ) from its revised value in September, marking the third monthly decline, though still 20.3 points (22.1 percent) above its value in the corresponding month last year. In October, international quotations for pig meat fell, principally underpinned by reduced purchases from China.

“Bovine meat prices also fell, reflecting a sharp decline in quotations for supplies from Brazil amid market uncertainty surrounding import suspensions by its leading trading partners over mad-cow disease concerns. By contrast, poultry meat quotations rose, boosted by high global demand, while production expansions remained weak due to high feed costs and avian flu outbreaks, especially in Europe. World ovine meat prices also increased slightly on continued supply limitations from Oceania due to high demand for flock rebuilding.”

After six consecutive monthly increases, sugar prices also dropped, by 1.8 per cent, amidst limited global demand and large surpluses for export.

“The FAO Sugar Price Index averaged 119.1 points in October, down 2.1 points (1.8 percent) from September, marking the first decline after six consecutive monthly increases.

International sugar quotations remained, however, more than 40 percent above their levels in the same month of last year, mainly underpinned by concerns over reduced output prospects in Brazil.

“The recent monthly decline in international sugar prices was triggered by limited global import demand and prospects of large export supplies from India and Thailand. The weakening of the Brazilian Real against the US dollar also contributed to lowering world sugar prices in October. Higher ethanol prices in Brazil, however, prevented more substantial sugar price declines.”