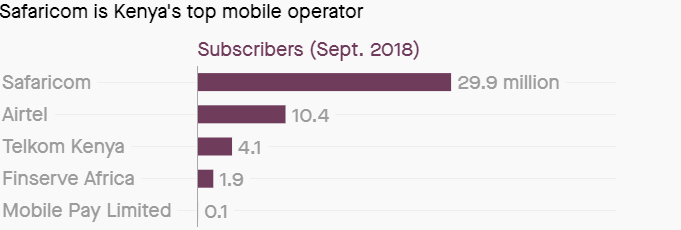

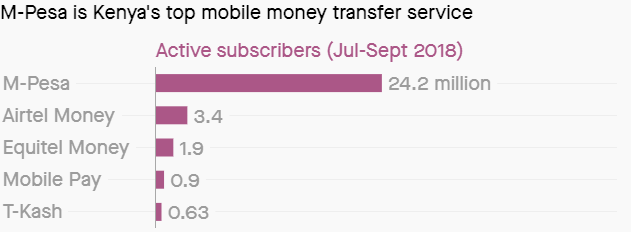

Airtel and Telkom are merging to create a stronger challenger to the market leader, Safaricom.

Indian-owned Bharti Airtel and Telkom Kenya announced a deal to operate under a joint venture company that will be named Airtel-Telkom.

The two companies said the deal comprises their corresponding mobile, carrier, and enterprises services but won’t include Telkom Kenya’s real estate portfolio and specific government services. Telkom Kenya is 60% owned by private equity firm Helios and 40% owned by the Kenyan government.

The two entities will continue to run independently but will combine efforts to enhance their range of products, marketing services, and offerings to customers. The closure of the transaction is subject to regulatory approval.

Talks on the two telcos merging surfaced last year but ultimately didn’t succeed because Airtel reportedly walked out.

The last time a deal of such magnitude happened in Kenya’s telecoms sector was in 2014, when Safaricom and Airtel struck a deal to buy India’s Essar Telecom, which operated under the Yu brand, for about $100 million.

Under the deal, Airtel took Yu’s subscribers while Safaricom took up the frequency and phone masts.

And Safaricom, in a bid to become a telecoms operator of the future, deepen its presence, diversify its operations and wade off competition, has also invested in or launched a number of innovative products in the past few years.

It made pacts with global remittances Western Union and PayPal, launched ride-hailing and music streaming services, an e-commerce platform, besides a WeChat-like app that integrates chatting with mobile payment services.

And if the company has any worries about the new Airtel and Telkom merger, it’s currently not showing: last month, CEO Bob Collymore welcomed the unification of the two firms saying the deal would only enhance competition in the sector.