|

Getting your Trinity Audio player ready...

|

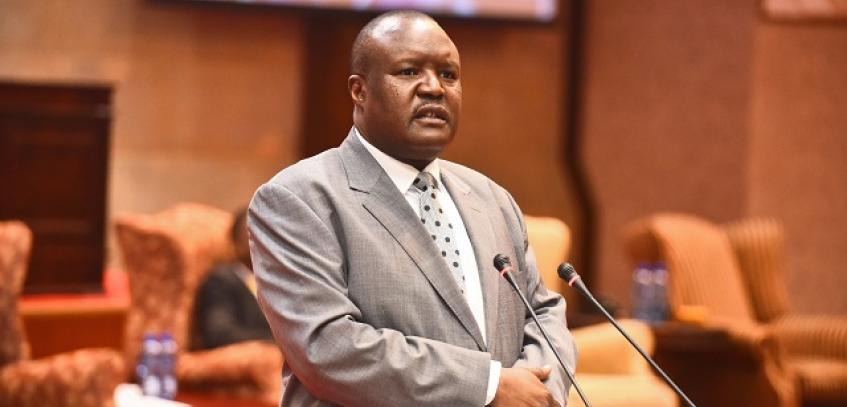

By Dr. John Mangudaya (Governor, RBZ)

The Monetary Policy Committee (MPC) of the Reserve Bank of Zimbabwe (the Bank) met on 24 June 2022 and deliberated on macroeconomic and financial developments in the economy. The MPC also deliberated on the progress made in the implementation of measures announced by His Excellency, the President of the Republic of Zimbabwe on 7 May 2022, which measures, the MPC noted, had begun to bear fruit, with the convergence of the auction and the willing-buyer willing-seller foreign exchange rates.

The MPC expressed great concern about the recent rise in inflation, which increased to 30.7% on a month-on-month basis for June 2022 thereby increasing the year-on-year inflation for June 2022 to 191.6%. The Committee noted that the increase in inflation was undermining consumer demand and confidence and that, if not controlled, it would reverse the significant economic gains achieved over the past two years. In that regard, the MPC resolved to put in place the following measures to align the interest rates with the inflation developments, enhance the circulation of foreign exchange and introduce an investment instrument to assist holders to store value in gold coins:

Interest Rates and Statutory Reserves

The MPC reviewed interest rates and statutory reserves with effect from 1st July 2022 as follows:

i. increasing the Bank policy rate from 80% to 200% per annum;

ii. Increasing the Medium Term Accommodation interest rate from 50% to 100% per annum;

iii. Increasing the minimum deposit rate for ZW$ savings from the current 12,5% to 40% per annum and increasing the minimum rate for ZW$ time deposits from 25% to 80% per annum; and

iv. Maintaining the Statutory Reserve Requirements at the current levels of 10% for demand and call deposits and 2.5% for savings and time deposits.

Liquidation of Unutilised Retained Export Receipts

In order to enhance the circulation of foreign currency in the economy, as well as to support the willing-buyer willing-seller foreign exchange market, the MPC resolved to maintain the current export retention thresholds across the various sectors of the economy and that 25% of the unutilised export receipts shall be liquidated at the willing-buyer willing-seller exchange rate after 120 days from the date of receipt of the export proceeds.

Introduction of Gold Coins as a Store of Value

The MPC resolved to introduce gold coins into the market as an instrument that will enable investors to store value. The gold coins will be minted by Fidelity Gold Refineries (Private) Limited and will be sold to the public through normal banking channels.

Forward Market for Foreign Currency

Having noted the widespread use of forward pricing in foreign exchange by some economic agents, the MPC resolved that mechanisms to formalise forward pricing arrangements should be created through the development of a market for forward exchange rates. The appropriate measures in this regard will be announced in due course.