Engineer Jacob Kudzayi Mutisi

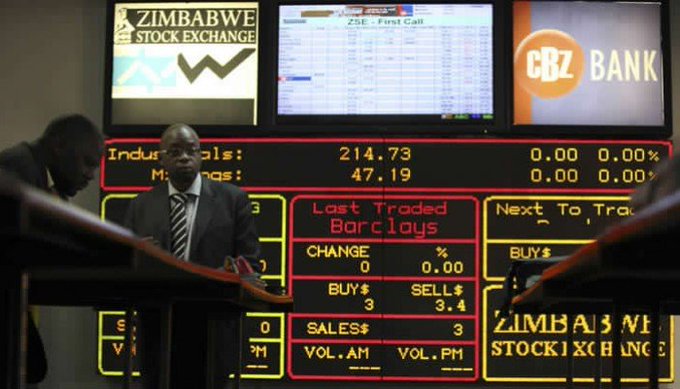

As a shareholder with equity in every listed company on the Zimbabwe Stock Exchange (ZSE) with the majority of them battling to survive. The time has come to ask how the Zimbabwean companies and the South African companies survived during the time when sanctions were imposed on them in the 60s and 70s. Furthermore, how was it possible that Zimbabwe had the best economy and one of the best performing stock exchange in the world during that era even though the country was at war?

What is it that the Rhodesians did very well that we cannot copy, paste and do even better. For God’s Sake the dividends we are getting from listed companies are a disgrace yet the CEOs are earning massive salaries, some even earning footballer’s salaries. The simple question is, do we have the right CEOs running Zimbabwe’s corporates? Is there any reason why listed companies are dominated by Chartered Accountants (CA) with the largest number of CAs being CEOs, CFOs, Finance Directors and Non-Executive Directors?

Some of the leading CAs were the people leading failed banks, manufacturing companies and even owning these companies that have since shutdown or are under liquidation. With the same CAs leading the liquidation process. This domination of CAs and the perception that they are the best is the reason why Zimbabwean companies are failing. To an extent that some rundown companies and none of these failing CEOs are prosecuted when there is proof of corrupt activities e.g. banks that have shutdown.

It is a fact that listed companies are supposed to be audited and in most cases these listed companies are audited by individuals who were their juniors during their articles of training and you expect these individuals to give negative or unfavourable financial reports to their superiors, the people that trained them? This is a big problem as this kind of arrangement has the potential to continue to breed corruption in Zimbabwe’s corporates.

Over the years the question has been, how is it possible that a listed bank or company can go bankrupt yet it is audited twice every year and it is given a clean bill of health during auditing and a few weeks later a bank or a company is closed. How is that possible????? The answer is simple you expect a junior to report that his senior is failing, NEVER they will lay the blame on everything else apart from themselves.

Here is the problem!!! The Big 4 auditing firms control 98% of the most revenue source with listed companies being the biggest contributors. However, that is not where it ends. The role of the auditor’s profession is that auditors are essentially outsiders who are engaged by an organisation to provide a review of what the directors and management has been doing and then provide assurance to us shareholders that all is in order or it is not. To achieve this objective, auditors are actually appointed by the shareholders to oversee management during an AGM. This is achieved through an audit committee whose terms of reference include the need to appoint independent auditors on an annual basis. The reason “independence” is so crucial is that they should be some objectivity in the process, and once this is compromised the risk that management can get away with shenanigans is elevated.

They make us believe they are independent yet in actual fact they are not. Most, if not all big conglomerate and listed companies that have shutdown or are in liquidation either had a CEO who was a CA or the majority shareholder/s.

Following the closure of banks there was a demand by the then liquidator Ngoni Kudenga for the Directors of banks to be prosecuted with majority of them being CAs. There was also a request by the then CEO of DPC, John Chikura for the depositors to sue the banks’ directors, yet the Institute of Chartered Accountants did not de-register or do anything to the CAs who were behind the banking collapse.

As a Zimbabwean shareholder I am calling my fellow shareholders to move away from this perception that CAs are trained to be CEOs NO!!! they are trained to be auditors and accountants not to run strategy in an organisation. The fact that they dominate most boards of companies and listed companies is not a god given right that they have to end up as CEOs. If you look at listed companies that are run by individuals who are not CAs these companies are run much more efficiently and have better results.

Time has come for other players to fight to be CEOs and not allow the CAs to continue to dominate a platform that other qualified, tried and tested individuals are ready and equipped to deliver. We cannot allow this kind of domination in Zimbabwe were domination has a history of creating corruption.